Russia’s war in Ukraine and the Western sanctions that have followed are putting pressure on countries in Central Asia that import grain and other critical supplies from the region.

On Thursday, Uzbek President Shavkat Mirziyoyev said his country must join the Chinese as well as Korean and Japanese food production chains as soon as possible. He also urged the Uzbek embassies in Europe, Turkey and India to reach out to local companies.

Tashkent is also offering incentives to Russia-, Ukraine- and Belarus-related firms and is opening the Uzbek market wider for food producers, according to Mirziyoyev's press service.

The five former Soviet states in Central Asia rely on each other and Russia for imports of grain.

In Central Asia the prices of wheat and flour have been increasing in the last few years because of the COVID-19 pandemic and regional droughts. That’s likely to continue with the Russia-Ukraine war and the possibility Russia will temporarily halt grain exports to former Soviet countries.

Experts say Central Asian nations are now shopping around.

“No grain trade with China yet but Uzbekistan, which heavily relies on Kazakhstan, just like other neighboring countries, could definitely consider other suppliers due to the worsening situation in Russia and droughts in Kazakhstan,” said an observer in Uzbekistan who asked to remain anonymous.

Central Asian countries are close or direct neighbors of China and an important part of Beijing’s Belt and Road Initiative. In recent years, China has invested in infrastructure projects in those countries through BRI.

Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan, with a collective population of 73 million, have limited economic growth due to limited natural resources, harsh climates and less efficient infrastructure, according to UCLA business administration professor Christopher Tang.

“China imports [from these countries] crude oil, petroleum gas and metals to China. In exchange, Central Asia imports apparel, electrical machinery, cars and equipment from China,” Tang told VOA.

Countries in Central Asia also have strategic value to China based on their location, according to Tang, who says Beijing is likely to export some grains to the former Soviet republics to establish goodwill and improve ties.

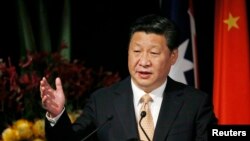

“Case in point, China’s President Xi has pledged 50 million COVID-19 vaccine [doses] to Central Asia in January 2022,” Tang said. “This move indicates China’s willingness to support Central Asia.”

According to Abdulmajid Muminzoda, Tajikistan’s anti-monopoly agency head, the mostly mountainous country of Tajikistan relies heavily on imports of wheat from Kazakhstan, Russia and Uzbekistan.

“In 2020, 94 percent of grain imports were from Kazakhstan, 5 percent from Russia and the rest came from Uzbekistan,” Muminzoda told VOA.

Since the beginning of this year, the prices of wheat, oil, sugar and other consumer products have seen a 15 percent hike on average, according to Anvar Akilov from Tajikistan’s customs service.

“The price of 50 kilograms of flour equaled a monthly pension of a retired former [Soviet] kolkhoz laborer in Tajikistan already in 2021,” said Irna Hofman, research associate in the faculty of Oriental studies at the University of Oxford. “Any further increase in prices, that happens in conjunction with overall inflation and dwindling remittances, will severely impact livelihoods.”

How the situation further develops in Central Asia regarding wheat and flour supplies and prices will depend on how the whole chain of trade and production unfolds, said Hofman.

“In ‘normal’ years, Kazakhstan imports wheat from Russia, and exports higher-quality domestically produced wheat to Kyrgyzstan, Tajikistan [and] Afghanistan.” Hofman told VOA.

According to Hofman, if Russia continues to halt exports to Kazakhstan, the Kazakh government may temporarily ban or limit exports depending on its domestic situation and reserves.

“In Tajikistan, a few Chinese companies are producing grains [maize, wheat and rice] and are also involved in breeding seed varieties. They sell the produce [and seed varieties] on the domestic [i.e., Tajik] market,” Hofman told VOA. “At the moment, there is no export to China. This may be different for Kazakhstan.”

Last October, the United States Department of Agriculture reported that from 2020 to 2021, grain exports from Kazakhstan to China remained “frustratingly low” due to persistent border closures.

Hofman pointed out that Chinese companies such as China Oil and Foodstuffs Corporation mainly rely on Ukraine for sunflower imports. Depending on the duration of the conflict and impact, such companies may look for alternative suppliers, including Kazakhstan, in response to falling imports from Ukraine.

In December, Nikkei Asia reported that China hoards over half the world’s grain, driving up grain prices.

China's current grain reserves are at a “historically high level,” Qin Yuyun, head of grain reserves at China’s national food and strategic reserves administration, told Xinhua news in November.

VOA stringer in Tajikistan Ozod Mas'ul contributed to this report.