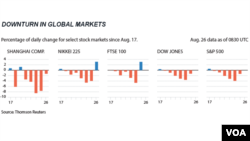

Waves of selling by investors in China drove Shanghai stock prices down again Wednesday, despite traders' earlier hopes that a five-day stretch of colossal losses could be reversed.

The move by China’s central bank on Tuesday to raise interest rates and try to pump more money into the economy helped stabilize stocks, but only briefly. The Shanghai Composite index later gave up gains and closed down 1.3 percent in choppy trading.

By contrast, U.S. stocks snapped a losing streak, with key indexes moving up about 4 percent. The Dow Jones industrial average, which had suffered double-digit declines over the last five sessions, soared 619 points, the third-highest point gain in its history. Government economic data showing a larger-than-expected rise in orders by U.S. manufacturers buying supplies for future production aided the surge.

European markets dropped sharply at first, then regained confidence and regained almost all of their losses on the hope of further monetary support by the European Central Bank.

Other bright spots among global markets were Japan’s Nikkei index, which jumped 3.2 percent, and Korea’s Kospi, which closed 2.6 percent higher.

Brokers in the West said some investors were regaining confidence after the market turmoil that peaked last week when China devalued its currency.

The continuing decline in Shanghai, however, reflected the feeling by investors there that the Chinese government and central bank must take stronger action to support markets.

Manufacturing slump

Adding to the gloomy Chinese economic climate was a survey showing that activity in its manufacturing sector slumped sharply this month. A survey of 20 economists by the Reuters news agency indicated that experts believe official reports on the Purchasing Managers Index for August will show it contracting at the fastest pace in three years.

But traders at the New York Stock Exchange said it wasn't China’s slowing economy as much as it was China’s lack of transparency that's been making investors nervous.

Trader Stephen Guilfoyle told VOA that investor psychology has been more about caution than panic. And Alan Valdes at DME Securities blamed the market volatility on lower volumes typical of the summer months, coupled with uncertainty and eroding confidence about Beijing’s monetary policies.

Most analysts predict the volatility will continue until at least September. That’s when many economists believe the U.S. Federal Reserve will start raising interest rates, which have remained near zero since 2009. Lower interest rates help stimulate the economy.

Despite improving U.S. employment and housing data, a voting member of the U.S. central bank raised doubts Wednesday on the timing for a rate hike. William Dudley, president of the Federal Reserve Bank of New York, told reporters that recent turmoil in global markets made the idea of raising rates next month less compelling.

Chinese savings lost

On the streets of Beijing and in brokerage houses there, comments about the market’s movement and concerns about the country’s slowing economy were about as varied as the day’s volatile trading band.

More than 100 million retail investors trade in China’s stock market — more people than are members of the Chinese Communist Party. Many of them are elderly retirees. Some have put their life savings into stock investments and were wowed when the index climbed to more than 5,000 points in June. But since then, many have been crushed as the market plunged to below 3,000 points.

At one brokerage house in Beijing, dozens of elderly investors watched anxiously for a turnaround Wednesday, but that never came.

One man who claimed he escaped serious losses said he was concerned about retirees because they "have very little money to spend” and simply couldn't afford further reductions in their capital.

For those who play the market, a feeling of anger and desperation was setting in.

“Right now, I don’t have any confidence in the market,” said one investor surnamed Zhang. “We are terrified by all of the things that we’ve heard.”

How low the market could go is anyone’s guess. Shanghai’s main index has plunged more than 40 percent since June, and investors long accustomed to the government’s intervention are increasingly frustrated. Some have urged the government to step in and save the market and, in turn, small-time investors.

But while some are finding it difficult to chart their course, others see opportunity. In Beijing’s Central Business District, one worker surnamed Zhang, who does not play the market, said his parents do, and the past few days at home have been difficult.

“They of course feel a tremendous sense of loss when shares fall, but it’s not that bad,” Zhang said. “With share prices tumbling, it is a good time to buy.”

Prices, wages

The slowdown in China’s economy is becoming increasingly evident, and many Chinese say they are concerned the pace of slowdown could result in what call "a hard landing."

“I am worried about that, but there’s really nothing I can do,” said one IT worker.

Rising prices and stagnant wages are other concerns that many people bring up.

“Inflation is something that you notice. Everyone feels like their salary is never high enough and that prices keep going up,” said Yi, who works in the business sector.

The IT worker agreed. “The government has worked to keep prices down, especially food prices,” he said. “But rent and other living costs are rising. It really depends on what the government can do to improve the real economy.”

VOA's Mil Arcega contributed to this report from Washington.