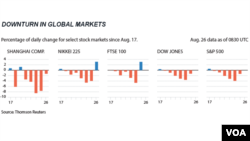

Stock markets rallied around the world Thursday after days of market turmoil driven by fears that China’s economic growth was slowing.

In a volatile trading session in New York, the Standard & Poor's 500, Dow Jones industrial average and NASDAQ composite index each gained well over 2 percent.

Stronger than expected data on U.S. economic growth was one factor that encouraged traders to bid up stock prices. The upbeat report also helped crude oil prices surge more than 10 percent, their biggest one-day rally in more than six years. They recovered much of the ground lost recently, as investors expected economic growth to generate more demand for energy.

In Europe, key stock indexes advanced more than 3 percent.

Earlier Thursday, Shanghai's key index jumped 5.3 percent, its biggest one-day gain in eight weeks. The gains, all recorded in the last 45 minutes of trading, helped investors recover some of the 23 percent in losses sustained over the previous five days.

The market in Hong Kong gained 3.6 percent, while in Tokyo the increase was more than 1 percent.

After staying out of the market earlier this week as it plunged, the Chinese government resumed its stock purchases. That apparently was an effort to stabilize the market ahead of the September 3 military parade celebrating the 70th anniversary of the World War II victory over Japan.

Over a longer period, the Chinese market had tumbled 42 percent since its mid-June peak, erasing more than $5 trillion in value as traders worried that the stock values were too high, with prices unjustified by China's slowing economy.

Chinese officials tried to stem recent losses by cutting interest rates in a bid to boost economic growth. A cheaper currency gives Chinese-made products a price advantage on global markets, which can encourage exports and growth. But it wasn't clear whether the rate cut was going to help stabilize stocks.

Traders at the New York Stock Exchange said China’s slowing economy wasn't as much of a concern as China’s lack of transparency in its policies.

Trader Stephen Guilfoyle told VOA that investors' recent pullbacks were more the result of caution than panic. And Alan Valdes at DME Securities blamed the market volatility on lower volumes typical of the summer months, coupled with uncertainty and eroding confidence about Beijing’s monetary policies.

Another concern has been the value of China's currency. Beijing unexpectedly allowed the yuan to weaken earlier this month, raising concerns Beijing was worried about its exporters, who have helped drive its massive economic growth.

On Thursday, China's central bank set its central rate for the yuan at a four-year low, at 6.4085 against the U.S. dollar, or about .07 percent weaker than the previous day.

Most analysts had predicted global market volatility would continue until at least September. That’s when many economists believe the Federal Reserve will start raising interest rates, which have remained near zero since 2009. Lower rates helped stimulate the U.S. economy, the world's largest, as it recovered from the steep 2008-09 recession.