German consumers' worries about the economy are deepening while business managers remain confident, according to two closely-watched surveys released Thursday. Analysts warn both polls were conducted before Volkswagen became mired in scandal, which could have wide-ranging effects.

The GfK research group said its forward-looking consumer climate index dropped to 9.6 points for October from 9.9 points in September. The three indicators that provide the index number — willingness to buy, income expectations and economic expectations — all fell, it said.

"In light of the global economic risks, numerous flash points and the recent sharp increase and largely uncontrolled influx of refugees, citizens apparently have increasing doubts regarding further economic development," GfK said.

The survey of some 2,000 consumers was conducted before the news broke that Germany's Volkswagen, the world's top-selling carmaker, had manipulated emissions tests in the U.S., raising the likelihood the index might suffer a further drop next month.

Separately, the Ifo think tank released its business confidence index, showing an overall improvement to 108.5 points in September from 108.4 the month before. The Ifo index is a monthly survey of some 7,000 companies that are asked for their assessment of the current economic situation and their outlook for the coming months.

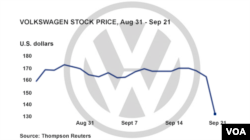

Carsten Brzeski, chief economist at ING Germany, noted that the Ifo index should also be considered outdated because of the Volkswagen scandal. CEO Martin Winterkorn resigned Wednesday saying he took responsibility for the "irregularities" found by U.S. inspectors in VW's diesel engines while insisting he'd personally done nothing wrong.

A supervisory board member said Thursday, however, he expects further resignations and VW has filed a criminal complaint with German prosecutors seeking to identify those responsible for any illegal actions in connection with the scandal.

"It still is unclear what the impact from recent allegations will really be," said Brzeski. "Needless to say, owning 12 brands in seven European countries and having a global market share of around 13 percent of all passenger cars, there will be an impact."

The refugee crisis could also result in significant direct costs, such as the expense of building shelters for hundreds of thousands of people and additional state financial support, said Brzeski. The longer-term effects on the labor market were still unclear, he said.