WASHINGTON —

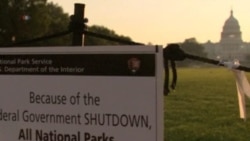

As the U.S. government budget crisis enters a second week, there are concerns that the rivalry between Democrats and Republicans in Congress may force the United States to default on its obligations. This would cause serious problems for both the national and global economies. As the shutdown continues, the world is observing developments in the U.S. capital with bewilderment and concern.

The top Republican leader in the U.S. House of Representatives has signaled that he may allow the United States to default for the first time in history if President Barack Obama refuses a compromise on federal spending. The United States must increase its debt ceiling by October 17 to be able to pay for government debt already accrued.

The president, a Democrat, has said that he is open to negotiation with the Republicans on any issue, but not amid such threats.

"We're not going to negotiate under the threat of further harm to our economy and middle class families. We're not going to negotiate under the threat of a prolonged shutdown until Republicans get 100 percent of what they want. We're not going to negotiate under the threat of economic catastrophe that economists and CEOs increasingly warn would result if Congress chose to default on America's obligations,” said Obama.

Analysts are warning that a prolonged shutdown could have harmful effects on the U.S. economy, but that the U.S. defaulting on its debt would be even worse.

Klaus Larres, a professor of international relations at the University of North Carolina, claims the consequences would be disastrous for the world as it continues to recover from the 2008 financial crisis.

"I think the Great Recession would be back with a vengeance, and we would be back in severe economic and financial difficulties. So I can only warn that the debt ceiling problem should not be mixed up with the shutdown of the government," said Larres.

Larres also said that a default on the U.S. debt would have immediate consequences that would reverberate around the world. For example, it could undermine the U.S. dollar's position as the global reserve currency and even the U.S. role as the world's strongest economy.

"It has never happened before that such a big country as the United States, a leading superpower of the day, is defaulting on its debts for technical reasons - because the United States is still a very rich and wealthy country; the money is there," said Larres.

The U.S. economy is not the only one that would be affected by a default. China is concerned about more than $1 trillion it has invested in the United States and is urging the United States to raise its debt ceiling.

Larres believes much of the world, especially countries with authoritarian governments, such as China, is having difficulty understanding this U.S. crisis.

"’What is the debt ceiling, why does the government need to raise the debt ceiling?’ These are all questions people are wondering about because apart from the United States and Denmark, a debt ceiling doesn’t need to be raised by any other country in the world, so obviously, no one really understands that," explained Larres.

According to Larres, so far the effects of the U.S. government shutdown continue to be mild, and with a timely solution the situation could be quickly rectified. However, he says, a prolonged impasse and a deeper crisis could have a negative effect that could undermine the position of the United States as the world's political and economic leader.

The top Republican leader in the U.S. House of Representatives has signaled that he may allow the United States to default for the first time in history if President Barack Obama refuses a compromise on federal spending. The United States must increase its debt ceiling by October 17 to be able to pay for government debt already accrued.

The president, a Democrat, has said that he is open to negotiation with the Republicans on any issue, but not amid such threats.

"We're not going to negotiate under the threat of further harm to our economy and middle class families. We're not going to negotiate under the threat of a prolonged shutdown until Republicans get 100 percent of what they want. We're not going to negotiate under the threat of economic catastrophe that economists and CEOs increasingly warn would result if Congress chose to default on America's obligations,” said Obama.

Analysts are warning that a prolonged shutdown could have harmful effects on the U.S. economy, but that the U.S. defaulting on its debt would be even worse.

Klaus Larres, a professor of international relations at the University of North Carolina, claims the consequences would be disastrous for the world as it continues to recover from the 2008 financial crisis.

"I think the Great Recession would be back with a vengeance, and we would be back in severe economic and financial difficulties. So I can only warn that the debt ceiling problem should not be mixed up with the shutdown of the government," said Larres.

Larres also said that a default on the U.S. debt would have immediate consequences that would reverberate around the world. For example, it could undermine the U.S. dollar's position as the global reserve currency and even the U.S. role as the world's strongest economy.

"It has never happened before that such a big country as the United States, a leading superpower of the day, is defaulting on its debts for technical reasons - because the United States is still a very rich and wealthy country; the money is there," said Larres.

The U.S. economy is not the only one that would be affected by a default. China is concerned about more than $1 trillion it has invested in the United States and is urging the United States to raise its debt ceiling.

Larres believes much of the world, especially countries with authoritarian governments, such as China, is having difficulty understanding this U.S. crisis.

"’What is the debt ceiling, why does the government need to raise the debt ceiling?’ These are all questions people are wondering about because apart from the United States and Denmark, a debt ceiling doesn’t need to be raised by any other country in the world, so obviously, no one really understands that," explained Larres.

According to Larres, so far the effects of the U.S. government shutdown continue to be mild, and with a timely solution the situation could be quickly rectified. However, he says, a prolonged impasse and a deeper crisis could have a negative effect that could undermine the position of the United States as the world's political and economic leader.