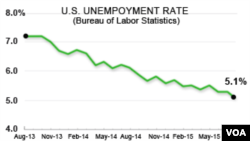

The U.S. unemployment rate fell to the lowest level in 7 1/2 years in August but job growth fell short of expectations, offering mixed signals about the economy as Americans prepare to celebrate Labor Day on Monday.

Friday’s report from the Labor Department shows a jobless rate of 5.1 percent, down two-tenths of a percent from the previous month, meaning roughly 8 million people seeking work remain unemployed. The report also says the U.S. economy had a net gain of 173,000 jobs, which is less than most economists had predicted.

The report says health care and financial services sectors gained jobs, while mining and manufacturing lost positions.

This report provides key data that leaders of the U.S. central bank will consider as they decide how soon and how much to raise the benchmark interest rate, which has been at a record low level since 2008, in a bid to boost economic growth during the financial crisis.

The Federal Reserve tries to manage the economy so there is both full employment and stable prices.

WATCH: Related video from VOA's Mil Arcega:

The declining jobless rate could be seen as evidence that the recovering economy no longer needs support from low interest rates. But the disappointing job creation number might support arguments to hold off on raising interest rates for a while.

Economic expert Mark Hamrick of Bankrate.com says the new jobs report does not give clear guidance to Federal Reserve leaders as they gather later this month to weigh interest rates. Bankrate.com does economic research for the financial industry and focuses on interest rates and the economic changes that affect them.

White House economic adviser Jason Furman says the economy gained 8 million jobs over the past three years, but warns it could face "headwinds" — problems that hurt growth — from the global economy.

PNC Bank analysts call this a "strong" report on the U.S. labor market, but adds that the Fed's decision on interest rates will be made at the last moment.