Many U.S. voters are worried about the economy and job preservation, but a researcher who examined the performance of stocks and bonds in Democratic and Republican presidential administrations asserts that neither side has a monopoly on economic wisdom.

Republican Donald Trump is a leading contender in the race to become his party's nominee for president. The flamboyant billionaire tells voters his business skills make him best qualified to boost the economy.

"We need a leader that wrote The Art of the Deal,” said Trump, referencing his 1987 book. “We need a leader that can bring back our jobs, can bring back our manufacturing."

Stock market

Financial expert Robert Johnson said the U.S. stock market does far better, though, when Democrats hold the White House than when Republicans are in charge.

"Under Democrats, the S&P 500 from 1965 through 2008 returned 14.61 percent, and under Republicans, returned only 7.73 percent," he said.

Johnson, who is president and CEO of The American College of Financial Services in Bryn Mawr, Pennsylvania, said data in later years show very similar results. Johnson worked with researchers at several schools to examine what link, if any, existed between the party in power and market results.

The results related to the stock market might encourage Hillary Clinton, a leading candidate for the Democratic Party's presidential nomination.

Policies by Democrats kept the nation from lapsing into recession, "saved the auto industry, provided health care to 16 million working people, and replaced the jobs we lost," Clinton said, pledging to strengthen and continue such policies.

Bond market

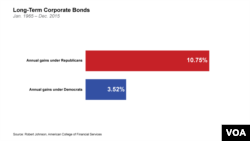

But Johnson said the corporate bond market, which is very large, does far better under Republicans than Democrats.

"Bonds do much better under Republican presidents than under Democratic presidents," he said. "Corporate bonds returned on average 10.75 percent. Under Democrats, corporate bonds only returned 3.52 percent so there was over a 7 percent difference."

Johnson cautioned that looking at just one factor to measure the very large and complex U.S. economy is simplistic. The professor said that whatever correlations there are between the party in power and the performance of different markets does not prove that one event caused the other.

This seems particularly true since one indicator does better under one party and the other expands under the rival group.

Economic growth

A 2014 study by Alan Blinder and Mark Watson shows that since World War II, economic growth has been consistently higher under Democrats than Republicans.

When the Princeton University economists examined the kinds of economic changes that can be controlled, or at least influenced, by presidents — like tax cuts or military spending — they concluded that these factors did not explain the differences in growth.

They found that things that can't be controlled by a president — like sharp changes in oil prices or advances in technology that boost productivity — seem more relevant in explaining the differences in economic growth between presidents.

The pair concludes that it makes little sense to give credit or blame to a leader who has little control over these economic changes.

Looking at other economic data produces mixed results.

Unemployment, inflation

The unemployment rate soared under Republicans Richard Nixon, Gerald Ford, and both George Bushes. It also rose, and then fell, under Democrat Barack Obama and declined in the administration of Democrat Bill Clinton.

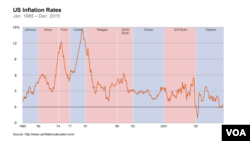

Inflation soared during the administrations of Republicans Nixon and Ford, and rose even higher under Democrat Jimmy Carter. Inflation dropped while Republicans Ronald Reagan and George W. Bush were in the White House, and fell low enough to spark worries about deflation under Obama.

As a general economic policy prescription, many Republicans say cutting taxes, government spending and regulations help businesses expand, and that boosts economic growth. Meanwhile, Democrats often argue for an increase in the minimum wage and seek other protections for workers and limits on the power of business.

The authors of The Third Way, a book that discusses the intersection of politics and economics, say Washington politicians have "missed the point" on economic issues.

Upendra Chivukula, a Democrat, and Veny Musum, a Republican, say a struggling middle class and growing income inequality are key reasons that voters are worried about the economy.

They contend that advancing technology is making the economy more and more dependent on capital goods, which are generally owned by the wealthiest segment of the population.

Chivukula and Musum argue that public policies that give the middle class more access to capital could boost growth and ease political tensions. They say laws that encourage employee ownership of companies also would help.