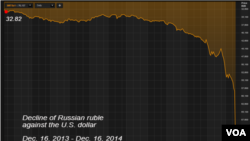

The value of the Russian ruble plummeted to new lows Tuesday, even after the central bank imposed its biggest interest rate increase in 16 years in an emergency attempt to prop up the rapidly declining currency.

At one point, the currency plunged to 80 rubles to the dollar and 100 to the euro, before regaining some lost ground in late-day trading on the Moscow Exchange. The ruble has lost nearly 60 percent of its value against the key Western currencies this year.

After an emergency meeting, economy minister Alexei Ulyukayev said several measures would be taken to help resolve the crisis, but he ruled out strict control on the purchase of foreign currency.

The ruble dropped even after Moscow's central bank dramatically raised its benchmark interest rate from 10.5 to 17 percent, in hopes of stemming the sell-off of the currency.

In Washington, the White House announced that President Barack Obama plans to sign legislation unanimously approved by Congress that calls for tightening U.S. economic sanctions against Moscow for its actions in Ukraine. It also would give Obama the authority to provide $350 million worth of lethal weapons and other military assistance to Ukraine, whose forces are fighting pro-Russian separatists in the eastern part of the country.

Just last week, Russia attempted, and failed, to stop the ruble's decline by raising interest rates by one percentage point.

Russian Prime Minister Dmitry Medvedev has met with key Russian financial officials about the crisis. The Kremlin has tried to reassure Russian citizens the devaluation will be temporary and that the ruble will eventually regain its value.

But the turmoil over the value of the ruble is not likely to end soon. The central bank said Monday inflation could reach 11.5 percent in the first three months of 2015 before easing. At the same time, the bank says that the Russian economy is likely to contract next year.

The currency has diminished with the precipitous drop in the price of oil, the backbone of Russia's economy, and the effect of U.S. and European economic sanctions imposed against Russia because of President Vladimir Putin's intervention in Ukraine in support of the pro-Russian rebels.

On Tuesday, oil prices dropped below $60 for the first time since 2009. Russia depends on oil and gas exporters for about half its federal budget.

While Russia's economy is heading into recession, economists say the government is not yet at risk of another default as it has a comfortable supply of foreign currency reserves.

According to Igor Nikolayev, director of strategic analysis at the Moscow-based audit consulting company FBK, Russian state companies, such as oil firms and banks, are at increased risk of bankruptcy as the falling ruble and sanctions make it difficult for them to finance their debts.

Russia's stock markets tumbled several percentage points on the ruble woes.

Investment has been fleeing Russia since the Kremlin's March annexation of Ukraine's Crimean peninsula prompted Western sanctions.

Oil on world markets — both Brent crude oil from the North Sea and the West Texas Intermediate drilled in the United States — traded at below $60 a barrel Tuesday.

The World Bank predicted last week that if the price of oil averages $78 a barrel next year, the Russian economy would drop seven-tenths of one percent.

But a steeper economic decline is certainly possible, since oil prices have dropped nearly in half since the middle of the year. If oil prices stabilize at the $60 level, the central bank said the Russian economy could contract by as much as 4.8 percent next year.

VOA correspondent Daniel Schearf contributed to this report.