LONDON —

A mild winter and improved infrastructure mean Europe and Ukraine are less reliant on Russian natural gas than in past years, easing worries that the escalating crisis in Ukraine could hurt supplies.

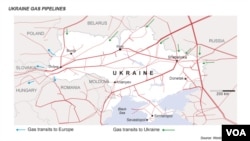

Russia is Europe's biggest gas supplier, providing around a quarter of continental demand. Around a third of Russia's gas is exported through Ukraine, which itself also relies heavily on imports to meet its own demand.

Fears for the stability of supply to Europe increased over the weekend when Russian forces took control of Ukraine's Crimea region and President Vladimir Putin said he had the right to invade his neighbor to protect Russians there after the overthrow of ally Viktor Yanukovych.

Moscow has in the past cut supplies to Ukraine when negotiating prices with Kiev, causing shortages especially in central Europe, which gets most of its supplies from Russia.

Russia's Gazprom said on Monday that gas transit to Europe via Ukraine was normal, but it warned that it might increase prices for Kiev after the first quarter, raising concerns that gas could be used for political leverage in the crisis.

But analysts said a mild winter across Europe had left storage inventories unusually high, easing the impact of any potential supply cut.

They also said improved gas infrastructure meant much of Russia's supplies could go to western Europe via alternative routes, such as the Nord Stream pipeline, which goes through the Baltic Sea to Germany, or through a pipeline that passes Belarus and Poland and also goes into Germany.

“Low utilization means Ukraine's gas network is of lesser importance today than in the past,” Bernstein Research said on Monday in a research note.

But analysts warned that a further improvement of the gas infrastructure was still needed.

“Risks for Europe exist always, that is why it should pursue even more diversification projects further and develop liquefied natural gas [LNG] markets and new connectors in central and southeastern European regions,” said Anna Bulakh of the International Center for Defense Studies.

To prepare for a potential disruption, Ukraine's gas transit monopoly Ukrtransgas has also been increasing its gas imports from Russia in recent days, upping its stocks which now stand at four months worth of supplies.

Of Ukraine's 33 billion cubic meters (bcm) storage capacity, Gas Infrastructure Europe (GiE) data shows that around 80 percent is in its far west, so even in the case of a Russian intervention in Ukraine's predominantly Russian east, most storage assets would likely remain safe from seizure.

Healthy Stocks

After a mild winter, meteorologists expect early spring to bring warmer-than-usual conditions over most of Europe, implying weak gas demand will continue, adding to already high storage levels.

A European Commission spokeswoman said that there was around 40 bcm of gas in the European Union's storage sites, equivalent to almost 10 percent of the bloc's total annual demand.

“Europe is better prepared [than in the past,]” said Maria van der Hoeven, Executive Director of the International Energy Agency [IEA] in Brussels.

In Central Europe, which relies heavily on Russian supplies and was hard hit by previous cuts, Czech and Slovak inventories are filled between 35 and 45 percent, equivalent to 90 days of demand, and Polish reserves are at over 70 percent of capacity.

In Austria, the chief executive of national oil and gas company OMV even said that the country had enough gas to meet half a year of demand.

Hungary's gas stocks are lower, at roughly 22 percent of capacity, but because its inventory facilities are larger in volume, its reserves are still enough to meet almost two months' worth of demand.

Serbian officals also said that its underground gas depots had enough gas to help bridge a potential disruption of supplies from Russia via Ukraine and Hungary.

In Germany, Europe's biggest gas consumer and Russia's largest customer, inventories are more than 60 percent of capacity, equivalent to around 60 days of demand.

Despite the healthy stocks across Europe, benchmark UK gas futures rose by almost 10 percent compared with last Friday's close, to over 61 pence per therm on Monday afternoon.

Russia is Europe's biggest gas supplier, providing around a quarter of continental demand. Around a third of Russia's gas is exported through Ukraine, which itself also relies heavily on imports to meet its own demand.

Fears for the stability of supply to Europe increased over the weekend when Russian forces took control of Ukraine's Crimea region and President Vladimir Putin said he had the right to invade his neighbor to protect Russians there after the overthrow of ally Viktor Yanukovych.

Moscow has in the past cut supplies to Ukraine when negotiating prices with Kiev, causing shortages especially in central Europe, which gets most of its supplies from Russia.

Russia's Gazprom said on Monday that gas transit to Europe via Ukraine was normal, but it warned that it might increase prices for Kiev after the first quarter, raising concerns that gas could be used for political leverage in the crisis.

But analysts said a mild winter across Europe had left storage inventories unusually high, easing the impact of any potential supply cut.

They also said improved gas infrastructure meant much of Russia's supplies could go to western Europe via alternative routes, such as the Nord Stream pipeline, which goes through the Baltic Sea to Germany, or through a pipeline that passes Belarus and Poland and also goes into Germany.

“Low utilization means Ukraine's gas network is of lesser importance today than in the past,” Bernstein Research said on Monday in a research note.

But analysts warned that a further improvement of the gas infrastructure was still needed.

“Risks for Europe exist always, that is why it should pursue even more diversification projects further and develop liquefied natural gas [LNG] markets and new connectors in central and southeastern European regions,” said Anna Bulakh of the International Center for Defense Studies.

To prepare for a potential disruption, Ukraine's gas transit monopoly Ukrtransgas has also been increasing its gas imports from Russia in recent days, upping its stocks which now stand at four months worth of supplies.

Of Ukraine's 33 billion cubic meters (bcm) storage capacity, Gas Infrastructure Europe (GiE) data shows that around 80 percent is in its far west, so even in the case of a Russian intervention in Ukraine's predominantly Russian east, most storage assets would likely remain safe from seizure.

Healthy Stocks

After a mild winter, meteorologists expect early spring to bring warmer-than-usual conditions over most of Europe, implying weak gas demand will continue, adding to already high storage levels.

A European Commission spokeswoman said that there was around 40 bcm of gas in the European Union's storage sites, equivalent to almost 10 percent of the bloc's total annual demand.

“Europe is better prepared [than in the past,]” said Maria van der Hoeven, Executive Director of the International Energy Agency [IEA] in Brussels.

In Central Europe, which relies heavily on Russian supplies and was hard hit by previous cuts, Czech and Slovak inventories are filled between 35 and 45 percent, equivalent to 90 days of demand, and Polish reserves are at over 70 percent of capacity.

In Austria, the chief executive of national oil and gas company OMV even said that the country had enough gas to meet half a year of demand.

Hungary's gas stocks are lower, at roughly 22 percent of capacity, but because its inventory facilities are larger in volume, its reserves are still enough to meet almost two months' worth of demand.

Serbian officals also said that its underground gas depots had enough gas to help bridge a potential disruption of supplies from Russia via Ukraine and Hungary.

In Germany, Europe's biggest gas consumer and Russia's largest customer, inventories are more than 60 percent of capacity, equivalent to around 60 days of demand.

Despite the healthy stocks across Europe, benchmark UK gas futures rose by almost 10 percent compared with last Friday's close, to over 61 pence per therm on Monday afternoon.