A new report by researchers from Johns Hopkins University is giving China better than expected marks for its performance in helping to restructure the crippling debt loads carried by some African countries.

The report is based on a detailed evaluation of Beijing's participation in the Debt Service Suspension Initiative, or DSSI, an international vehicle for developed nations to support struggling countries like Angola and Zambia.

The DSSI was introduced in 2020 at the start of the global pandemic by the International Monetary Fund and World Bank, which suggested the world’s 20 largest economies, known as the G-20, temporarily halt the collection of loans from the world’s poorest nations.

U.S. Treasury Secretary Janet Yellen and World Bank Chief David Malpass have recently accused China of being a barrier to debt relief, and U.S. Vice President Kamala Harris was in default-stricken Zambia last week urging the country's bilateral creditors — of which China is the biggest — to do more on restructuring Zambia’s debt.

But, despite some caveats, the report released this week by Deborah Brautigam and Yufan Huang from the China Africa Research Initiative found that overall, China “fulfilled its role fairly well as a responsible G-20 stakeholder.”

The analysts added that China “did implement the minimum steps of the DSSI fairly well, communicating with other players, and following through on pledges.”

According to the available data, Chinese creditors accounted for 30 percent of all claims and contributed 63 percent of debt service suspensions in the countries that participated in the DSSI.

“The metric by which you evaluate [China’s] performance depends on what your expectations were for the initiative,” Brautigam told VOA, noting that this was the first time the world’s second-largest economy had joined a multilateral initiative – a move one G-20 source called “miraculous.”

Brautigam said it was obvious that a new architecture is needed to deal with debt relief because the current system is dominated by the Paris Club, a group of wealthy Western nations that started lending to developing countries in 1956. In recent years, there have been more major new creditors, like China and bondholders.

“So what evolves out of this is really up in the air,” she said, adding that all lenders “need to be in together because otherwise you get all these suspicions, you know, worries about free riding.”

Successes and failures

The study concluded that China might have achieved more during the DSSI if not for fears that countries would simply take advantage of any debt relief to repay other creditors.

In Zambia, for example, Chinese creditors wanted assurances their relief wouldn’t be used to pay off the bondholders, while the bondholders were concerned that any relief from their side might go toward paying off China.

China was “totally justified” in its suspicions on this front, Brautigam said, because “in most countries, all of those creditors continued to be paid.”

“We need something that is simultaneous - you know, they all need to be in the room together … so that we don’t have this first-mover problem,” she added.

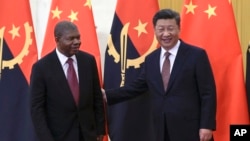

In Zambia, the Chinese decided against suspending their debt payments while the country was still paying bondholders, but this didn’t happen in Angola, China’s largest African borrower with around $20 billion in debt to Chinese entities. In that case, Chinese creditors provided 97% of the debt relief over the two-year period without asking for assurances that Angola wouldn’t continue making other repayments.

The researcher’s third African case study, Kenya, showed how China’s DSSI treatment was different from the other two. Chinese banks agreed to provide relief at first but later stopped loan disbursements and suspended only some 40 percent of the expected amount in 2021.

Moving forward

The study also showed how China's banks and central government, despite the country's top-down political structure, do not always act in unison. The fragmented nature of the Chinese system and bureaucratic hurdles often remain a barrier to debt relief.

Being part of the DSSI helped address that because it “pushed the Chinese government to align interests among fragmented banks and bureaucracies with conflicting goals. This process, still under way, is a necessary step toward full acceptance of the necessity for debt restructuring in the post-pandemic era,” the researchers found.

The DSSI ended in December 2021 and has been superseded by what’s known as the Common Framework to continue helping indebted countries like Zambia with their restructuring.

In January, World Bank chief Malpass said, “China is asking lots of questions in the creditors' committees, and that causes delays, that strings out the process.” Last month, Yellen accused Beijing of leaving developing countries “trapped in debt.”

China has called on the IMF and World Bank to also offer debt relief, with President Xi Jinping saying at the G-20 summit last year: “International financial institutions and commercial creditors, which are the main creditors of developing countries, should take part in the debt reduction and suspension for developing countries."

The Chinese Embassy in Zambia hit back at the U.S., calling Yellen’s “debt trap” comments “irresponsible and unreasonable.”

Ultimately, the study found, “the DSSI was a success in what some saw as its primary goal: to bring China into a multilateral, G20-supervised forum where Beijing has an equal voice.”

It now remains to be seen how the challenges highlighted by the pandemic relief program spill over into the current debt negotiations.