Pakistan on Thursday confirmed it had been placed on the Financial Action Task Force's "gray list" over its alleged failure to choke off terror financing, although the global financial watchdog has not yet announced the decision.

Muhammad Faisal, spokesman for Pakistan's foreign office, verified FATF's decision during a press briefing Thursday, adding that Pakistan's inclusion on the list was not unexpected.

"We were told in February that we will be placed on the gray list. We will have to ensure the implementation of the action plan shared with FATF while we are on the gray list. If adequate measures are taken, we can be removed from the list," Faisal told reporters.

The FATF, which is currently holding its weeklong plenary session in Paris, has said it will make a formal announcement Friday.

Pakistan's confirmation came a day after the Islamabad delegation presented a comprehensive 26-point, anti-terror-financing strategy to the 37 FATF member countries.

International pressure

Earlier this year, the United States, France, Britain and Germany introduced a motion to the FATF, alleging Pakistan's failure to adhere to the international guidelines for curbing terror financing and money laundering.

In February, during a meeting in Paris, FATF member countries decided to put Pakistan on the gray list in an effort to increase pressure on the South Asian country to take adequate measures against terror financing on its soil.

Although the decision did not surprise many inside the government, Pakistan still fears the decision will negatively affect the country's economy and hamper foreign direct investment.

Analysts from Pakistan say the FATF decision is evidence the country needs to devise a concrete and comprehensive strategy to avoid being added to FATF's black list.

"Being on the gray list might not hurt the economy as badly as being added to black list will do," retired Lieutenant General Talat Masood, a prominent defense and security expert, told VOA.

"It seems the country will have to do more, although I still believe Pakistan has taken adequate steps in the past few months to counter terror financing," Masood added.

New regulations

The Securities and Exchange Commission of Pakistan (SECP), the country's national financial authority, last week adopted a framework for compliance with FATF's recommendations to counter money laundering and terrorist financing, in a document titled Anti-Money Laundering and Countering Financing of Terrorism Regulations 2018.

According to the SECP, the new law will help identify criminals and militant elements that hide behind the "complex ownership structure of companies or other similar forms."

Dr. Tahir Rohail, a U.S.-based South Asian affairs expert, said that while he appreciated Pakistan's new laws, he was cynical about the willingness among the leadership to enforce them.

"There is a contrast between the ideology of Pakistan's civil side and the security establishment that is protecting the militant elements with established terror ties," Rohail told VOA. "So, what is the use of these laws if there is no implementation?"

Khalid Farooqi, a Brussels-based security analyst, echoed Rohail's concerns, adding, "Laws have been crafted, but what is the point of these laws? [Pakistani cleric] Hafiz Saeed's groups are still collecting funds. Where is the implementation of the laws?"

Automatic blacklisting

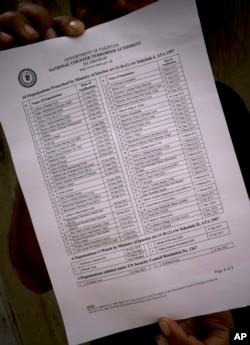

In February, Pakistan President Mamnoon Hussain approved amendments to the country's anti-terrorism law that allowed the government to automatically blacklist groups placed on the U.N. terror watch list.

The legislation authorized the government to seize the operations of U.N.- and U.S.-designated terror groups Jamaat-ud-Dawa (JuD) and Falah-e-Insaniat Foundation (FIF), which are both linked to Saeed.

Saeed is alleged to be the mastermind of the 2008 Mumbai attacks that killed more than 160 people, including six Americans. Following the attacks, Saeed was placed on the U.N. sanctions list. He was designated a global terrorist by the U.S. in 2012.

Over the past several years, Saeed has been put under house arrest several times, only to be later acquitted by the Pakistani courts, which stated there was a lack of evidence to establish Saeed's links to the Mumbai terror attacks.

Pakistan has remained under criticism from the U.S. and India for not doing enough to hold Saeed accountable for his terrorist activities. Despite being placed on the terror watch list, Saeed's groups JuD and FIF have in the past openly collected funds and have enhanced their influence throughout the country.

Terror financing

Terror financing still remains a challenge in Pakistan, where militant and extremist groups have openly generated large sums of money under the guise of religion and welfare for the poor. The funds are allegedly being used for terror activities within and outside the country.

Militant groups collect money using different methods and sources in the country, largely relying on foreign funding, drug trafficking, extortion from businesses and kidnapping for ransoms. The Hawala system, a parallel banking system, is another convenient method militants use to launder their money.

The international community has repeatedly expressed concern about Pakistan's noncompliance with the international guidelines for curbing militants' financial sources in the country.

Shahnaz Nafees from VOA's Urdu service contributed to this report.