ABUJA —

When they first announced the new currency, a 5,000 Naira note, worth about $30, it seemed like an innocuous story. Economists said it was a good idea. It would save money in printing and storing cash and promote a more modern economy.

After the announcement, Ugo Okoroafor, a bank spokesperson, held press conferences and took interviews, enthusiastically introducing the public to the new money.

“Let’s not look at Nigeria now. We are moving into a society where there will be vending machines. There are parking meters that are coming up. The rail lines are coming back to life. These are areas where coins are very important," he said.

What was initially a rumble from people who didn’t like the idea quickly turned into a roar. Lawmakers and political analysts said if money was worth more, crooked officials could haul away more simply because it was less bulky.

Wole Olaoye has been a journalist in Nigeria for almost four decades. He sits on the editorial board of one national newspaper and writes columns for another. He was and remains an outspoken critic of the new currency.

"If you have a 5,000 Naira bill, the politician is going to dance because he’s going to be happy. It’s going to make it easy for him to carry his bribes around, either bribes that he’s giving people or bribes that he’s receiving. And we don’t kid ourselves that this doesn’t happen. It happens on a daily basis," he said.

Last summer the Nigerian Central Bank announced plans to introduce new currency worth five times the value of the current largest bill. The move set off a torrent of controversy with critics saying it would allow corrupt officials to line their pockets with five times more money. Now the currency has been shelved and lawmakers are reviewing the powers of the central bank.

When they first announced the new currency, a 5,000 Naira note, worth about $30, it seemed like an innocuous story. Economists said it was a good idea. It would save money in printing and storing cash and promote a more modern economy.

After the announcement, Ugo Okoroafor, a bank spokesperson, held press conferences and took interviews, enthusiastically introducing the public to the new money.

“Let’s not look at Nigeria now. We are moving into a society where there will be vending machines. There are parking meters that are coming up. The rail lines are coming back to life. These are areas where coins are very important," he said.

What was initially a rumble from people who didn’t like the idea quickly turned into a roar. Lawmakers and political analysts said if money was worth more, crooked officials could haul away more simply because it was less bulky.

Wole Olaoye has been a journalist in Nigeria for almost four decades. He sits on the editorial board of one national newspaper and writes columns for another. He was and remains an outspoken critic of the new currency.

"If you have a 5,000 Naira bill, the politician is going to dance because he’s going to be happy. It’s going to make it easy for him to carry his bribes around, either bribes that he’s giving people or bribes that he’s receiving. And we don’t kid ourselves that this doesn’t happen. It happens on a daily basis," he said.

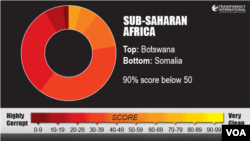

Olaoye calls corruption "a way of life" in Nigeria that can be found everywhere from street cops to high-level officials. Earlier this year, lawmakers issued a report showing that $6.8 billion worth of Nigerian public funds had been stolen by oil moguls and officials between 2009 and 2011.

As a result of the currency controversy, the National Assembly held a hearing and declared it would investigate the matter, even though the bank by law had sole authority to update the currency.

In late September, President Goodluck Jonathan told the bank to halt the currency plan and, amid other controversies, lawmakers are now looking into ways to reduce the authority of the Central Bank.

As a result of the currency controversy, the National Assembly held a hearing and declared it would investigate the matter, even though the bank by law had sole authority to update the currency.

In late September, President Goodluck Jonathan told the bank to halt the currency plan and, amid other controversies, lawmakers are now looking into ways to reduce the authority of the Central Bank.