Thailand is emerging as one of Russia’s main pipelines for machine and computer parts with the potential for military use, with a growing number of local companies accused of helping Moscow evade Western export controls meant to cripple its war on Ukraine.

Since Russia’s full-scale invasion of Ukraine in February 2022, the United States has imposed sanctions on seven companies in Thailand for exporting these “high priority items” to Russia, the last of them in December.

Trade data published last year by S&P Global, a financial analytics and services firm based in New York, also show a huge spike in these exports out of Thailand since 2022.

Thailand eluded mention when the U.S. Treasury and Commerce departments started warning in mid-2023 of third countries being used to funnel high-priority items to Russia as a way of skirting the West’s export controls.

“So, it was a surprise to see them … as a new country or a new location which had been involved in this type of goods transaction,” Byron McKinney, a sanctions risk and supply chain expert at S&P Global Market Intelligence, told VOA of his team’s research.

Supply chains hit by sanctions, McKinney said, are “a little like water in a stream — if you try damming in one place, it will try and move around. So, Thailand kind of appeared in this way, as a country which wasn’t there originally for the transshipment or transit of these goods but has appeared later on.”

Within days of the 2022 invasion, the U.S. Commerce Department placed export controls on dozens of high-priority items it said Russia needed most “to sustain its brutal attack on Ukraine,” from ball bearings to microchips. These are commonly known as dual-use goods for their potential to be put to both civilian and military use.

A 2024 report by McKinney and his team shows China exporting or reexporting the vast majority of these goods to Russia since the invasion — over $6 billion worth in 2023 alone. It also shows countries funneling more such goods to Russia than Thailand.

But of the 14 countries whose exports and reexports to Russia that the report breaks down, Thailand saw the sharpest spike of any, from $8.3 million in 2022 to $98.7 million in 2023, a jump of over 1,000%.

Thailand’s 2023 shipments also included an especially large proportion of the most sensitive, high-priority goods such as microchips, designated by U.S. Customs as Tier 1.

More recent data shared with VOA by S&P Global show Thailand’s exports and reexports of high-priority goods to Russia again topping $90 million in 2024.

McKinney said the trade routes on which the goods are shipped are in constant flux.

But for the time being, he added, “Thailand just happens to be in an area where there’s the possibility to transit these goods easier or quicker because maybe the regulation is a bit more light touch, for example, than it would be in other locations. So, it kind of gets picked on from that particular perspective and … turns up as a particular transit or transshipment hub.”

The U.S. has put sanctions on seven Thailand-registered companies in the past 13 months.

The first was NAL Solutions in January 2024. In announcing the sanctions, the U.S. Treasury Department said NAL was part of a network of companies controlled by Russian national Nikolai Aleksandrovich Levin channeling electronics and other goods from the United States and other countries to Russia.

Washington sanctioned another five firms in Thailand in October, including Intracorp, which Treasury accused of setting up other companies that send high-priority goods to Russia.

Treasury also tied Thailand’s Siam Expert Trading — added to the sanctions list in December — to the TGR Group, which it described as “a sprawling international network of businesses and employees that have facilitated significant sanctions circumvention on behalf of Russian elites.”

Five of the seven firms did not reply to VOA’s repeated requests for comment about the sanctions. The other two could not be reached.

Spokespersons for the Thai government and Ministry of Commerce, which oversees the country’s exports and company licensing, did not reply to VOA’s requests for comment either.

Since the full-scale invasion of Ukraine, Thailand has been keen to keep up warm diplomatic and economic ties with Russia.

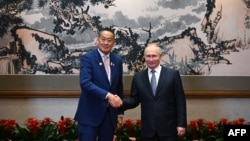

At an international summit on China’s Belt and Road Initiative in Beijing two years ago, Thailand’s prime minister at the time, Srettha Thavisin, hailed his country’s “close relations” with Russia, shook hands with Russian President Vladimir Putin and invited him to Thailand.

“When Srettha became prime minister in 2023, he was focused like a laser on economic growth and viewed Russia as a useful economic partner,” Ian Storey, a senior fellow at the ISEAS-Yusof Ishak Institute in Singapore, told VOA. “Visa-free entry was extended for Russian tourists, and the authorities turned a blind eye to incidents of antisocial behavior and illegal activities.”

He said Prime Minister Paetongtarn Shinawatra, who replaced Srettha last year, has carried on both his fixation on economic growth and neutral stance on the Russia-Ukraine war.

Just last month at Putin’s invitation, Thailand joined BRICS, a group of developing countries with Brazil, Russia, India, China and South Africa at its core, focused on forging closer economic ties.

And while bilateral trade between Russia and Thailand has been falling in recent years, Storey says Russians have become major players in Thailand’s property market. They have also helped boost Thailand’s tourism sector, a pillar of the economy.

In an interview with Russia’s state-owned TASS news agency in 2023, Vitaly Kiselev, president of the Thai-Russian Chamber of Commerce, said Western sanctions on Moscow were also opening up more trade opportunities between Russia and Thailand. He said chamber membership was on the rise.

Given Thailand’s priorities, and U.S. President Donald Trump’s approach to negotiating an end to the Russia-Ukraine war, Storey doubts that Thai authorities will step in to stop the country’s trade in dual-use goods.

“If Bangkok hasn't taken action to crack down on this trade three years after the war started, there's little chance that it will do so now, especially as the Trump administration is making nice with Russia,” he said.

Across Asia, only Japan, Singapore, South Korea and Taiwan have imposed trade restrictions or other sanctions on Russia since the 2022 invasion.