Iran rejected appeals Wednesday from other oil-producing states to curb its oil exports to try to end the plunge in world crude oil prices, instead saying it intends to increase production.

Iran's envoy to the Organization of the Petroleum Exporting Countries, Mahdi Asali, said Tehran intends to step up exports until they reach the level it had before international economic sanctions were imposed on it in an effort to force Iran to agree to a ban on its suspected development of nuclear weaponry.

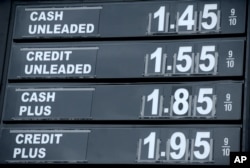

As the Iran nuclear agreement took effect last month, the sanctions were lifted and Iran says that within the next six to 12 months it intends to send another million barrels of oil a day onto the world market. That would add to the glut that has pushed prices down from $115 a barrel in mid-2014 to the current $30 range.

Pre-sanction levels

Before the sanctions took effect in 2012, Iran exported 2.5 million barrels a day, a figure that the United Nations and Western sanctions cut to about 1.1 million.

Iranian oil officials met Wednesday in Tehran with their counterparts from Iraq, Venezuela and Qatar, discussing a plan adopted the day before by Saudi Arabia, Russia, Venezuela and Qatar to freeze their oil production at January levels on the condition that other large oil states do the same.

But Asali rebuffed the notion that Iran should maintain its production levels.

"These countries increased their production by 4 million barrels when Iran was under sanctions," Asali told the Shargh daily newspaper. "Now it's primarily their responsibility to help restore balance on the market. There is no reason for Iran to do so."

He said the four countries that agreed on the oil production freeze could stabilize oil prices on their own, if they cut their production by 2 million barrels a day.

Doha agreement

Saudi oil minister Ali al-Naimi said the January production levels are "adequate," but that the agreement reached in Doha is only good if other large producers sign on as well.

"We don't want significant gyrations in prices," Naimi said. "We don't want a reduction in supply. We want to meet demand and we want a stable oil price."

The pact to freeze production marked a shift in Saudi oil policy. For months, as oil prices have plunged, Riyadh had refused to curb its production in an attempt to force other oil producers, especially U.S. shale oil producers, out of the market.

But with producers across the globe pumping too much oil, coupled with some economies slowing and thus not needing as much oil to fuel their industrial production, prices continued to fall.

That in turn has hurt oil-dependent government budgets, particularly in Russia and Venezuela. But even oil-rich Saudi Arabia, with some of the world's biggest untapped oil reserves, says it has a record budget deficit.

The Doha meeting could be a signal that oil-producing nations, including OPEC members, might eventually agree to an outright production cut to halt the 19-month slide in prices to their lowest point in more than a decade.

Some analysts have predicted that prices will eventually fall to at least $20 a barrel before any recovery begins.