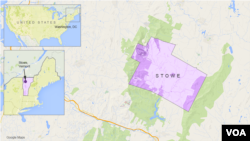

Felipe Vieira moved from his home in Brazil to the tiny town of Stowe, Vermont, under a program that allows foreign investors the chance to become a permanent U.S. resident.

But he says after handing over $500,000, he and others who backed a development project at a pair of ski resorts are worried their dreams will be dashed. The project, which involves a hotel and a biomedical research plant, is the subject of a federal fraud lawsuit filed earlier this month.

"Everybody is scared to death," Vieira said Wednesday.

He was at an event where the state's governor and other officials gave assurances the resorts have a bright future, despite their operations being placed under the control of a court-appointed attorney who said "financial statements paint a very bleak picture."

Vieira invested under what is known as the EB-5 visa program. Launched in 1992 to stimulate the economy, it allows foreigners to put $1 million into a new commercial venture that must create 10 new jobs. If the project is located in a rural area or one that has lost a lot of jobs, the figure drops to $500,000.

Those projects have included the Barclay's Center arena in New York, development on Washington's Southwest Waterfront and numerous hotels across the country.

Conditional residency

Investors who get an EB-5 visa earn a conditional residency status in the U.S. for two years, after which they can apply to become a permanent resident. Out of the 140,000 employment visas the U.S. allocates each year, about 10,000 of them are allowed to be EB-5s.

The program has exploded in recent years, with approvals for the first step rising from 642 in 2008 to 8,756 in 2015. China is the dominant source of those granted EB-5 visas, accounting for 8,156 last year. Out of 71 other countries and regions on the list, only Vietnam, Taiwan, South Korea and India had even 100 nationals get an EB-5.

That massive expansion has brought concerns about fraud on both sides of the transaction.

The U.S. Government Accountability Office issued a report identifying questions about the source of the money from the foreign investors, who must provide that information in their application. It also highlighted questionable practices by businesses that accept the money, saying because investors are also seeking residency, they may not follow due diligence before agreeing to the deal. The U.S. Securities and Exchange Commission has launched multiple investigations, including civil action in four EB-5 cases.

The SEC is the plaintiff in the lawsuit against Ariel Quiros, owner of Q Resorts, which in turn owns the Jay Peak resort; and William Stenger, the president and CEO of Jay Peak.

Massive fraud scheme

It alleges a "massive eight-year fraud scheme" in which Quiros and Stenger were primarily responsible for misusing more than $200 million of the $350 million raised from foreign investors. The money came from over 700 people in more than 70 different countries, with Stenger telling them they would earn returns of between 2 and 6 percent. The suit says the defendants made numerous misrepresentations and omissions to the investors and diverted millions of dollars for their own use.

"The most recent project, for which the defendants continue to raise money from unwitting investors, purports to be for a nearby $110 million biomedical research center that the defendants have operated as nearly a complete fraud."

The developers are also trying to raise $98 million for a hotel project, and in recent months have gone on fund-raising trips to Vietnam, Dubai, Istanbul, Hong Kong, Singapore and South America, the suit says.

Those who have already invested fear that if the projects never open, the jobs are not created and their permanent residency evaporates.

The day after the lawsuit was filed, the court appointed Michael Goldberg as the receiver in charge of the 15 companies named along with Quiros and Stenger.

Business as usual

Two weeks later he detailed the troubling financial situation in a filing to the court, laying out questions about how much the resorts actually profit and a lack of funds to complete construction of the planned additions. He also cited the difficulty the ski resorts have in making money outside of ski season.

But on Wednesday Goldberg gave a more positive assessment, declaring "business as usual." He said he secured enough funding to keep Jay Peak open and that he expects the hotel cited in the lawsuit to open in the fall.

"The only thing we're praying for is snow in the winter right now," he said.