Despite a daily outpouring of bitter criticism against the U.S. trade action, the Chinese leadership seems to be actually learning lessons and taking reform measures it has avoided for years.

In recent months, China has initiated new foreign investment and intellectual property protection laws and imposed punishment on local companies forcing their foreign partners to surrender technologies. The government has tried to assuage local sentiment by making it easier for Chinese companies to access finance.

China plans to push through the new legislation during its annual meetings of the National People’s Congress, which begins next week. The moves by the largely rubber stamp legislative body are aimed at trying to quickly resolve the trade dispute with Washington.

American pressure

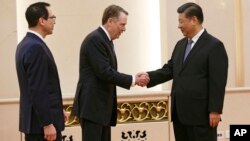

Analysts said Xi Jinping is using American pressure as an excuse to push through his reform agenda and cut through the resistance he was facing from a section of the Communist Party and state-owned enterprises.

“There’s pressure that has come at the right time, and this was where the Chinese President Xi wanted to take the Chinese economy to, and it has all come at the same time,” Sourabh Gupta, senior fellow at the Institute of China-America Studies in Washington, said.

“But without the push from Donald Trump and the American administration, we would not be seeing reform happening so fast and so quickly as in the last couple of months,” he said.

This is ironic because Chinese officials and the official media has been running an intense campaign against the Trump administration’s trade actions, calling them a sign of the U.S. President’s “dictatorial ways” and “American arrogance”.

U.S. pressure led to fears of losing out on foreign investment in Beijing’s official circles. The government moved decisively last November, imposing 38 different penalties on Chinese companies that pressure their foreign partners to surrender technologies. China has also promised to bring in a full-fledged law to provide intellectual property protection to foreign investors.

In addition, China is bringing in a new foreign investment law that aims to “set up and improve the mechanism facilitating foreign investment” and to create an “open, fair and transparent” business environment for foreign companies, the Ministry of Commerce said.

“Many of the things they are offering are changes they wanted to make anyway,” Julian Evans-Pritchard, China Economist at the consulting firm, Capital Economics. “It’s just the U.S. pressure requires them to speed up some of that legislation.”

Tariffs

A recent flash survey by the American Chamber in Commerce found that a majority of its members were in favor of keeping tariffs in place until the two sides hammer out a deal. At a briefing on Tuesday on its annual business survey of the business climate in China, the chamber said that about 10 percent were in favor of raising tariffs from 10 to 25 percent, after March 1. Another 43 percent supported maintaining the tariffs at 10 percent for another 60 days while Beijing and Washington worked out a deal.

The survey was conducted before President Donald Trump announced he was delaying the March 1 deadline.

In China, there are many who see American demands for restructuring of trade and the industrial policies as an important opportunity to hasten the country’s transition from a heavy reliance on exports to an economy that is dominated by the service and value-added sector.

“If China does not carry out structural reform, it will be difficult to achieve ‘the China Dream’ and it will certainly fall into the middle-income trap,” said Hu Xingdou, professor of economics at the Beijing Institute of Technology.

Sticking point

Analysts are asking if the new moves would be implemented on the ground soon enough to show results in a year or so, even if there is a trade agreement between the U.S. and China.

“The issue with China is not so much winning the negotiations. It’s what happens after the negotiations,” warns Andrew Hupert, author of ‘The Fragile Bridge: Conflict Management in Chinese Business.’

In China, the problem is not about regulations, old or new. It’s about how they are applied, and how much trouble a foreign investor must go through to obtain official approvals at the local level, Hupert said.

The U.S. should not declare victory by getting Chinese signatures on a deal, he said. There are myriad ways in which China’s provincial governments, bureaucrats and businessmen can bypass new rules meant to protect the interests of foreign investors.

“You close one loophole and another appears,” said Julian Evans-Pritchard, adding that “it doesn’t seem that they have come to an agreement on how this trade agreement is going to be enforced. So that remains a sticking point”.

It is not as if U.S. negotiators are unaware about the Chinese practices in rule implementation after decades of American business experience in China.

“The Americans are breathing down their neck in ensuring that those regulations are written on a pro market basis,” Gupta said.

Chinese analysts believe there wasn’t much that Beijing could do in the midst of the year-long trade war.

“For China, the trade war is drinking poison to quench one’s thirst,” Eric Zhang, former chief representative of the Oklahoma FDI Office in China, said. China stands to lose whether or not it accepts U.S. demands for reforms. Accepting the demands will also involve painful readjustment, he said.

VOA Mandarin service's Mo Yu contributed to this report from Washington