The International Monetary Fund has trimmed its annual forecast for global economic growth for 2015 as the world faces what the group’s chief economist calls “strong and complex cross currents.”

Despite reducing its growth forecast from its last prediction in October from 3.8 to 3.5 percent, the IMF’s chief economist, Olivier Blanchard, said the world’s economy is expected to grow slightly faster this year than it did in 2014.

Oil prices and the fluctuation in global exchange rates were two key points the group highlighted in its latest report.

Speaking with reporters in Beijing on Tuesday, Blanchard said that although the decline in oil prices will give global growth a boost, not all will benefit from the price reduction. The price of oil has plunged from around $100 barrel last June to below $50 a barrel.

“On the one hand, major economies are benefiting from the decline in the price of oil,” Blanchard said. “But on the other hand, in many parts of the world, lower long run prospects adversely affect demand, adversely affect investment and are resulting in a strong undertow.”

The decline in the price of oil will help importing countries across the globe, but not oil exporting countries such as Russia and Nigeria.

“For oil exporters and for firms involved in new forms of energy production, this is clearly bad news,” Blanchard said.

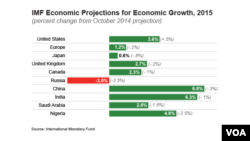

In its report, the IMF said the revision of its forecast is based on a reassessment of prospects for growth in China, Russia, the Euro area and Japan. The United States was the only major economy in the report that had its growth projections raised.

According to the IMF, the United States should see growth around 3.5 percent in 2015, a half percent higher than the projection the group made in October.

Japan was one of the major disappointments of 2014, Blanchard said, noting that the momentum for structural reform there is still too weak to raise expectations about future growth and to spur investment.

Japan and the euro area, which both saw their forecasts cut, could benefit from currency fluctuations, he said.

Since August, the dollar has risen seven percent, while the euro and yen have depreciated. This could slow the recovery in America, but may help Japan and the euro area out of their slump, Blanchard said.

In sub-Saharan Africa, economists say that lower oil and commodity prices are also responsible for weaker growth forecasts, in particular in Nigeria and South Africa. Falling commodity prices are also lowering the growth forecast in countries in Latin America and the Caribbean.

Slower growth expected in China

Meanwhile, the outlook for China is expected to slip below seven percent this year. According to the IMF’s new forecast, the growth for 2015 is expected to continue to slow and slip to 6.8 percent this year.

But that is not necessarily a bad thing, Blanchard said.

“This reflects the welcome decision by authorities to take care of some of the imbalances that are in place and the desire to reorient the economy towards consumption and away from the real estate sector and shadow banking,” he said.

The slower growth will have an impact on the rest of Asia, he added.

On Tuesday, China announced its annual economic growth, saying it came in at 7.4 percent, the slowest growth rate China has seen since 1990. At that time, China was facing international sanctions following its brutal and bloody crackdown on student protesters in Tiananmen Square.