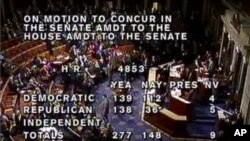

The House of Representatives has passed a sweeping federal tax bill based on a compromise crafted by President Barack Obama and congressional Republicans, despite passionate opposition by many liberal members of the president's own Democratic Party. The Senate passed the tax legislation easily on Wednesday, meaning the bill will now go to the president for signing. The vote on the bill was 277-148.

It was a high stakes showdown on the floor of the House of Representatives and the final vote came at midnight.

The legislative battle crossed party lines and saw Democratic lawmakers openly rebelling against their own Democratic president and their own leadership in Congress. A House vote expected much earlier in the day was abruptly postponed for hours after liberal members who oppose the bill were enraged at efforts by party leaders to limit opportunities for them to express their dissent.

The legislation extends Bush-era tax cuts for all Americans for two years, even the wealthiest, although the president and Democratic lawmakers originally had hoped to extend tax cuts for individuals for only the first $200,000 they earned in a year.

The $858 billion measure also extends unemployment benefits for 13 months for the long-term unemployed and imposes a two percent cut in payroll taxes. The president negotiated the compromise with a group of Republican lawmakers headed by Senate Minority leader Mitch McConnell and pushed hard for Congress to pass it, saying it is crucial to fuel economic growth and create jobs.

Many of the liberal Democratic members voted for an amendment, that ultimately failed, that would have raised the rate for the inheritance tax for multi-million dollar estates. If the amendment had passed, the bill would have gone back to the Senate, throwing the whole compromise into doubt.

Democratic Representative Jim McGovern of Massachusetts summed up the argument expressed by many liberal Democrats that it is immoral in times of economic hardship for so many working class Americans to give more tax breaks to millionaires.

"We have children go to sleep at night hungry, in the richest country in the world, we should be ashamed of ourselves. We can do better than add to the deficit by giving more tax cuts to the wealthy," he said.

Democratic Congressman Peter DeFazio of Oregon complained bitterly that the legislation will add almost $1 trillion to the already soaring U.S. national debt.

"Every other major industrial nation on earth is talking about buckling down a little bit and austerity measures and having a sustained recovery. No, not here. We got out the credit card. A trillion dollars. Well, no it's only $858 billion," he said.

The compromise came just weeks after Democrats suffered major losses in November elections across the country, losing majority control of the House of Representatives and losing some seats in the Senate. Democratic Representative Brad Sherman of California said that for Democrats, the basis for negotiating deals will worsen when the new Congress begins in January.

"If we do not send this bill to the president's desk this year, he will certainly sign a worse bill next year," he said.

Republican Mike Pence of Indiana said his vote against the bill was difficult, but necessary.

"We all know what we should be doing today, is voting to extend all the current tax rates permanently. The reality is that uncertainty is the enemy of prosperity," he said.

Other Republican lawmakers voted for the bill, saying they did not agree with all of it, but they do not want taxes to go up for all Americans at the beginning of the year.

For the first two years of his presidency, President Obama relied on a broadly-unified Democratic caucus in Congress to pass sweeping health care legislation, financial reform legislation and many other bills, many of them without a single Republican vote. Now, the president says voters have shown that they want their leaders to compromise and work together across party lines to tackle the severe economic challenges the United States is facing.

Both the House and the Senate would have liked to have finished up their agenda this week to leave town for the holiday recess, but they still have to fund the federal government for the current fiscal year.