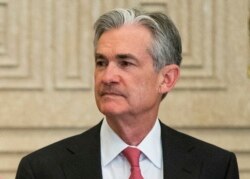

U.S. Federal Reserve Chairman Jerome Powell said Wednesday that Facebook's plan to build a digital currency called Libra couldn't go forward until serious concerns were addressed, comments that pressured the project and dented the price of the original cryptocurrency bitcoin.

The strong comments from the most powerful U.S. financial regulator underscored the growing regulatory hurdles facing the proposed cryptocurrency, which has drawn scrutiny from policymakers globally.

"Libra raises many serious concerns regarding privacy, money laundering, consumer protection and financial stability," Powell said during his semiannual testimony on monetary policy before the House Financial Services Committee.

"I don't think the project can go forward" without addressing those concerns, he added later.

Powell said any regulatory review of the project should be "patient and careful." He noted that existing rules do not fit digital currencies.

'Needs a careful look'

"It's something that doesn't fit neatly or easily within our regulatory scheme, but it does have potentially systemic scale," he said. "It needs a careful look, so I strongly believe we all need to be taking our time with this."

"We are very much aligned with the chairman around the need for public discourse on this," Facebook spokeswoman Elka Looks said in an email. "This is why we along with the 27 other founding members of the Libra Association made this announcement

so far in advance, so that we could engage in constructive discourse on this and get feedback."

Powell's comments about Libra hit the price of bitcoin, which fell as much as 7% during his three hours of testimony.

Late last month, bitcoin climbed back to near $14,000 and has rallied by more than 30% since June 18, when Facebook announced plans to launch Libra. By midafternoon on Wednesday, bitcoin was trading at $12,268.99, down 2.4% on the day.

Facebook shares, too, took a hit during Powell’s appearance before the committee, although they largely recovered that lost ground and were trading 1.3% higher at $201.89 a share.

Working group

It was unclear exactly how the Fed could slow the project if it wanted to, given the murky regulatory treatment of digital currencies, but Powell's perspective looms large. Facebook officials are scheduled to testify about the project later this

month in Congress, where senior lawmakers have raised data privacy and other concerns.

"What Facebook is planning raises serious privacy, trading, national security and monetary policy concerns for consumers, investors, the U.S. economy and the global economy," said California Democratic Rep. Maxine Waters, who chairs the Financial Services Committee.

Powell said the Fed had established a working group to follow the project and was coordinating with other central banks around the globe. He also said he expected a review from the U.S. Financial Stability Oversight Council, a panel of regulators charged with identifying broad risks to the financial system.

Much larger scale

Powell noted that he supports financial innovation if appropriate risks are identified, but he said the massive platform enjoyed by Facebook immediately sets Libra apart from other digital currency projects.

"Facebook has a couple billion-plus users, so I think you have for the first time the possibility of very broad adoption," he said.

Any problems that could emerge through Libra "would arise to systemically important levels just because of the mere size of Facebook."