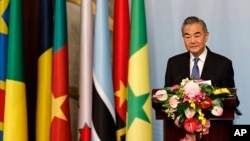

Critical minerals and oil, a renewed focus on the Atlantic coast, and the West’s loss of influence in the Sahel are some of the reasons analysts believe Chinese Foreign Minister Wang Yi has chosen the Republic of Congo, Nigeria, Chad and Namibia as the stops on his visit to Africa this week.

For decades it has been tradition that Beijing’s top diplomat makes his first foreign foray of the year to the African continent, and each time experts try to analyse the reasons behind the specific itinerary.

“It’s always a mix of big states and small ones. The main point of all of this is to show that China is a non-discriminatory partner; that it doesn’t have 'important countries,’ the way Western powers would tend to cherry pick,” Cobus van Staden, an editor at the China Global South Project, told VOA in a WhatsApp voice message.

During his first stop in Namibia on Monday, Wang said the 35-year-old tradition of starting the year with an Africa trip shows the world that “China remains Africa’s most reliable friend” and its “strongest supporter…on the global stage,” Chinese state news agency Xinhua reported.

Namibia and minerals

Namibia is Wang’s southern African pit-stop this year. The country “is China’s major maritime partner on Africa’s Atlantic seaboard, where the largest concentration of China’s port developments are located,” Paul Nantulya, a research associate at the Africa Center for Strategic Studies in Washington, D.C., told VOA.

Van Staden echoed this, noting that “the last year or two there seems to have been an emphasis on the Indian Ocean, this year they seem to be rebalancing towards the Atlantic.”

Namibia is also rich in uranium and critical minerals like lithium, cobalt and manganese.

Namibia’s president, Nangolo Mbumba, said at his meeting with Wang this week that Chinese investment “continues to play a significant role in developing Namibia’s uranium sector as one of the biggest global uranium producers.”

Mbumba and Wang also spoke about Chinese investments in infrastructure such as a planned desalination plant. Chinese companies are also starting to build Namibia’s largest solar power plant this year.

Republic of Congo and oil

After Namibia, Wang heads next to the Republic of Congo, another Atlantic seaboard country and the incoming African co-chair of the Forum for China Africa Cooperation or FOCAC.

The country, which is next to mineral-rich Congo, has untapped mineral deposits, but its economy is mainly based around oil, which accounts for some 80 percent of its exports, according to the World Bank.

Van Staden said “the diversification of Chinese oil imports” could be part of the reason for Wang’s visit to the country, as well as to the other two oil producers on the agenda: Chad and Nigeria.

“The Republic of Congo used to be a big oil exporter to China, but over the years China’s diversified its oil supplies,” he said.

However, the Republic of Congo is trying to increase production and last year Cogo, the Congolese subsidiary of China Oil Natural Gas Overseas, announced a $150 million investment in two oil fields there.

A Chinese company also holds a controversial permit to conduct oil exploration near a national park. In a September meeting between Chinese President Xi Jinping and Congolese President Denis Sassou Nguesso in Beijing last year, the Chinese foreign ministry readout stated, “China supports the Republic of the Congo in developing a diversified economy, and encourages Chinese enterprises to participate in the construction of major infrastructure and regional connectivity projects in the country.”

Over the years, China and its companies have been investing in major infrastructure projects in the Republic of Congo, building roads and modernizing the airport. It has gifted the country a new parliament building and construction is set to begin on a $9 billion hydropower dam this month.

Chad and security

Another country Wang will visit this week is Chad, the Central African nation that saw relations with Bejing elevated to a “strategic partnership” during last year’s FOCAC.

“Chad and its immediate neighbors play a key role in China’s effort to secure global supply chains of critical minerals in the high-tech and clean energy sectors, including the EV industry which China dominates so far,” said Nantulya.

Situated in the volatile Sahel region, which has seen a spate of coups in recent years, oil-rich Chad has been under military rule since a 2021 putsch. Chad is also one of several regional countries that have asked troops belonging to former colonial power France to leave amid rising anti-French sentiment.

In December, Chad ordered France to withdraw about 1,000 troops from the country, where it had long been helping to fight jihadist insurgents.

The void left by the West could be China’s gain, analysts said.

“It is the fifth former African French colony to remove French forces from its territory,” said Nantulya of Chad. “China has been showing great interest in ramping up its strategic security engagements with these countries as seen by the sharp increase in Chinese military engagement in Mali, Burkina Faso, Niger, and Senegal in particular, as well as Ivory Coast.”

Nigeria and trade

Analysts say one of the more obvious stops on Wang’s 2025 tour is Nigeria, Africa’s most populous country and one of its biggest economies.

Cliff Mboya, a postdoctoral fellow at the Center for Africa-China Studies at the University of Johannesburg, said trade would be a major item on the agenda.

“Looking at Nigeria, one of the issues that also came out strongly during the last FOCAC was market access for African products into China, and Nigeria was one of the leading countries pushing for this idea,” he told VOA. “So that will feature more prominently during Wang Yi’s visit to Nigeria.”

Security is also a factor, said Oluwole Ojewale, a Nigerian researcher at the Institute for Security Studies.

“If you also look at the things that bind Nigeria and Chad together, one of them is the counter insurgency operations that both countries have been involved in for a while now,” he told VOA. “Maybe the Chinese foreign affairs minister is also going to talk about security partnerships.”

Filling the void

Ojewale added that the stops on Wang’s trip can also be seen through the lens of regional geopolitical competition.

“Where the Western alliance and establishment have vacated in Africa, we’re seeing in equal proportion China or Russia in particular occupying those places — supplanting the Western alliance,” he said.

And while such trips happen every year, Van Staden said this year’s trip is especially significant given that on Jan. 20th the U.S. will see a change of government when president-elect Donald Trump starts his 2nd term in office.

“I think the main message that [the Chinese are] trying to send is that they’re a constant partner, that they’re not fickle,” he said. “This message is of course reinforced right ahead of the Trump inauguration, you know, where a lot of people expect a low level of interest in Washington in relation to Africa.”