China’s COVID-19-era border closures are stunting foreign-invested business growth in the world’s number 2 economy and testing Beijing’s quest for self-reliance, economists believe.

China’s pursuit of zero COVID-19 cases, rather than managing a steady caseload as many Western countries do, has kept foreign travelers out since March 2020, barred some long-term permit holders from returning and diverted marine shipping traffic.

Those barriers, which several media outlets anticipate will extend into 2022, have made foreign companies shrink their China presence, analysts say.

“Just in general they seem to be less open for any kind of cross-border activities, whether that’s domestic companies or foreign companies,” said Zennon Kapron, founder and director of the Shanghai-based financial industry research firm Kapronasia.

From factory managers to managing directors of overseas-invested companies, border restrictions mean China-based foreign nationals risk not being able to return after home leave, Kapron said. Some expatriates in those roles are skipping family events overseas, to remain in China, or moving out completely.

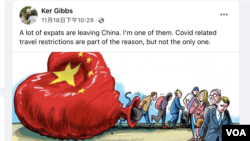

“A lot of expats are leaving China,” Ker Gibbs, president of the American Chamber of Commerce in Shanghai, said in a Facebook post November 18. “I'm one of them. COVID-related travel restrictions are part of the reason.”

Hardest hit are tech firms and other companies that are exploring the Chinese market, said Dexter Roberts, U.S.-based author of The Myth of Chinese Capitalism.

“I think those companies that really were focusing on the Chinese market, certainly foreign companies in like the knowledge services industries doing advertising, maybe trying to do commerce within China, really getting to know the Chinese consumer, I think those companies are probably harder to attract to come and live there because they’re not going to be able to leave for a long time,” Roberts said.

“And then I think also the Chinese government is less welcoming to a lot of different investors,” he said.

Financial sector investors and companies with “suppliers on the ground” should be able to withstand the border curbs, Roberts added. Other investors, he said, are figuring that China is “not what we thought before as a market” or “let’s pull out.”

COVID-19 Regulations by the numbers

In an omen for Chinese nationals leaving on business, the number of new and renewed Chinese passports fell more than 95% in the first half 2021 over the same period in 2019, the investment bank Jeffries said this month.

Shipments to and from China, known as the world’s factory for its $4.84 trillion manufacturing sector, sometimes get delayed when China closes a port to control a COVID-19 outbreak, said Song Seng Wun, an economist in the private banking unit of Malaysian bank CIMB. Detours to other ports add costs and disrupt supply chains, he said.

“For all of us in trade, whether you’re talking about a material, whether you’re talking about the construction industry, the nuts and bolts, all the way down to just foodstuff, it’s a case of which port do you ship out from becomes also a cat and mouse sometimes, so businesses essentially plan around it. Port A, port B, port C, worst case, if we have to ship out from Hong Kong, we will,” Song said.

A possible, partial reopening of the mainland China-Hong Kong border would become a “key growth driver” next year for Hong Kong banks because of their China exposure, bond ratings service Fitch said in a statement Friday.

Beijing’s state-run China Daily news website defended the Chinese “zero-COVID-19 approach” on November 9 and called the disease “largely under control.” Mainland China has reported no deaths since January, China Daily says.

“There is no doubt that, like any other place in the world, strict containment measures do affect people's lives and local businesses to some extent,” the report says. “However, it's simply not right to question China's efforts to eliminate the virus.”

Trend toward self-reliance

Some senior leaders in China think their country should “go it alone” without foreign business support, and the border closures give them a chance to steer the economy in that direction, Roberts said. An upcoming twice-per-decade congress of the ruling Communist Party will push leaders to make “risk-free” decisions and pull China “inward,” he forecast.

Chinese President Xi Jinping called in October for a “higher level of self-reliance” and linked that goal to development of enterprises along with an upgrade of industries through “independent innovation,” state-run broadcaster CGTN reported.

Foreign direct investment last year stood at $1.9 trillion after a 6% gain in 2020 over 2019, a U.N. Conference on World Trade and Development report said. China’s statistics bureau estimated total investments in fixed assets last year came to $8.2 trillion.

Officials are seeking breakthroughs in artificial intelligence, quantum computing, chips, robotics and the blockchain. The effort could cost half-a-trillion dollars every year.

The goal of “self-reliance” descends from the Communist Party’s first head of state, Mao Zedong, the Chicago-based Paulson Institute’s research organization, MacroPolo, said in 2019. The party “will retain ultimate control over China’s economic development—an enduring consensus that has heavily influenced policy across generations of leaders,” the think tank says.

China’s long-term goal and how it shapes up over the next two years is “anyone’s guess,” Kapron said.