Development specialists say agricultural investments can be structured in ways that do not involve buying land – for instance, getting companies to collaborate with small-holder farmers.

Lorenzo Cotula is a senior researcher at the International Institute for Environment and Development (IIED) in London.

He’s a co-author of several reports for the IIED, the U.N.Food and Agriculture Organization and the International Fund for Agricultural Development. Among them are “Making the Most of Agricultural Investment: A Survey of Business Models that Provide Opportunities for Smallholders” and “Land Grab or Development Opportunity: Agricultural Investment and International Land Deals in Africa.”

Cotula says there’s a widespread perception in government and investor circles that large plantations are needed to modernize agriculture. But he says there is no evidence to back up these perceptions. Smallholders have often proved dynamic and competitive on world markets, and policy and infrastructure support for smallholders is today more needed than ever.

According to Cotula, where outside investment is necessary to sustain agriculture, there are various models for collaboration between local farmers and investors, depending on the history, culture, and traditions of land ownership of the area.

Contract farming

One popular method is contract farming, which is often used with tree and cash crops and sometimes with fruit and vegetables.

"It has been around a long time," said Cotula, "and usually involves companies providing credit, inputs like seeds and fertilizer and training and then buying produce from farmers at a fixed price when harvest time comes."

The inputs provided by the companies are usually deducted from the final purchase price. The quality and quantity of the produce are agreed upon by the farmers and the companies.

Cotula says contract farming accounts for up to 60% of tea and sugar farming in Kenya and 100% of cotton farming in Mozambique. In Ghana, it’s used by companies like Blue Skies Agro-Processing, which processes fresh fruits like pineapple, mangos and watermelon for the European market.

Benefits and drawbacks

Contract farming has many benefits, enabling farmers to gain access to credit, seeds and technologies. Contract farming may also give smallholders more access to lucrative but remote markets for high-value crops.

But there are also drawbacks to contract farming. Cotula’s research reveals contracts often go to wealthier farmers, while poorer ones work as labor on the contracted farms. The price that companies pay to farmers may be low, and it may be difficult to penalize a company for not honoring purchasing agreements when market conditions change.

Also, growers may become locked into debt when the company deducts payments for inputs from the final purchase prices. Contract farming may also shift land access away from women, who grow subsistence crops, to men, who are more likely to sign contracts for cash crops with agribusinesses.

Joint ventures

Another model that has been used for partnerships between small farmers and investors is joint ventures, such as one in Rwanda between smallholders and the private company, the Nshili Tea Corporation. Another in Mozambique gives local landholders a 60% stake in an eco-tourism lodge in Manica province.

"[Joint ventures] involve local groups acquiring an equity stake in a company that runs agricultural production," explained Cotula. "Production could be undertaken by farmers on the basis of contract farming arrangements with the joint venture company. Or it could be like in Malaysia, where joint venture schemes usually involve establishing a large plantation with the local community having equity participation and receiving dividends – which however don’t always materialize."

Cotula says an equity stake in the business can give communities a voice in decision making and a steady income in the form of dividends.

On the other hand, he says, dividends may not materialize because of practices by the companies linked to the agribusiness. One, called “transfer pricing,” transfers profits by artificially inflating or deflating prices in transactions with companies linked to the agribusiness joint-venture partner. The practice reduces profits for the joint-venture company and dividends for smallholder partners. As a solution, contracts may require sales to affiliates take place at fair market prices.

Cotula has also studied other business models that involve collaboration with smallholders, including tenant farming and sharecropping.

Smallholder participation

The success of all of them often depends on the strength of local farmers’ organizations. He says it’s helpful if smallholders form cooperatives or unions or have the support of NGOs.

Cotula describes the case of sugar cane farmers in East Africa, where government-run processing plants have been privatized.

"As growers got organized into an association independent of the business," said Cotula, "they got a better deal in business terms…they also acquired greater voice in industry – like the setting of government policy. So, the level of organization, the capacity in the organization that represents the concerns and aspirations of farmers is crucial."

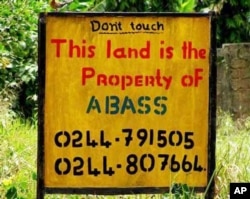

Research on large-scale land acquisitions shows that many contracts favor the investor: some are short and unspecific and do not include important clauses that protect the small farmer. They may also guarantee leases of between 50 and 99 years, leaving local people without land and livelihoods for generations.

Better practice

Better practice features mechanisms to monitor or enforce investor commitments, clarify the distribution of government revenues, specify the number and types of jobs that will be created, and balance exports with local food needs. It also includes promoting greater transparency.

Cotula’s research showed that Liberia is an example of better practice in that the government has made contracts publicly available on the web. Some contracts negotiated by Monrovia featured more specific commitments to jobs and training, local processing and procurement, and social and environmental safeguards.

Inclusive models for agricultural investment are an important part of efforts to reach the U.N.’s Millennium Development Goals, which include significant reductions in poverty and hunger, environmental sustainability, and the creation of effective partnerships to enhance development.