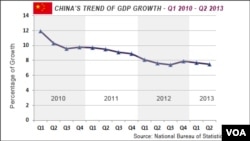

New economic data from China show the country’s growth slowing for the second consecutive quarter much as expected.

Official figures from the country’s statistics bureau indicate the economy grew 7.5 percent in the April to June period, compared to the same period a year earlier.

“China's economy has maintained a steady growth,” said Sheng Laiyuan, spokesman for China's National Bureau of Statistics, “The GDP totaled 24.8 trillion yuan ($4 trillion U.S.) in the first six months, up 7.6 percent from a year earlier. GDP grew 7.7 percent in the first quarter and 7.5 percent in the second."

Other growth indicators - such as factory output and investment - also weakened compared to a year ago.

Sheng Laiyuan said that the figures are all within the country's economic targets, but added that China's economic conditions are still “complex and changeable.”

The continuing slowdown comes as Chinese leaders push through measures aimed at rebalancing the country's economy, diminishing its reliance on manufacturing for exports and government investment in core industries.

Shaun Rein, managing director at the China Market Research Group, says that the latest data show China’s economy is still overly reliant in investments in physical assets, such as real estate and infrastructure.

“Fixed asset investment grew 20.1 percent year over year, that is still far too high, we should be more on the 18 to 19 percent range,” he said.

As Economy Slows, China Tries to Rebalance Industry

Rein says that more of the economy needs to depend on consumer spending and the latest figures show that may be happening. Retails sales grew 13.3 percent in the first half of 2013 - an indication that consumers are starting to account for a bigger slice of GDP growth.

“You still see continued consumer confidence, continued spending going forward,” he says, “but it's not an easy switch and there will be pains in the economy going forward as we make that shift.”

The Chinese government has been enacting a series of policies to curb speculation in sectors like real estate, construction and banking, which traditionally accounted for much of the Asian giant’s economic growth.

Sheng Laiyuan said that such interventions will prove essential in the long term.

“Some measures, including the intensified property-tightening campaign, new rules to curb misuse of public funds and the exit of some previous stimulus policies, will inevitably have some impact on growth in the short term, but they will benefit our economy in the long run," he said during Monday's news conference.

Further Signs of Slowing Ahead

In a research note published on Monday, Nomura economists Zhiwei Zhang and Wendy Chen said that growth remains on track to achieve government's target of 7.5 percent for 2013.

But the economists revised down their GDP growth forecast for next year, from a previously forecasted 7.5 percent to 6.9 percent.

Zhang says that a decline in the workforce, as well as delays in structural reforms are contributing factors in the decision to lower estimate growth for 2014.

“The working-age population dropped in 2012 - the first time in at least 20 years - and this is a really big deal, because it changed the supply of labor and make the labor market much tighter then before and push up wage growth, and hurt China comparatively particularly in the export sector,” Zhang said in a conference call on Monday.

At the same time, Zhang says, policymakers have overlooked the development of private companies.

“The government tried in the past five years to encourage private investment and open up monopolies in the protected sectors, but there is very little action to follow up with those guidelines,” Zhang said.

In recent months, senior government officials have stressed the need to achieve a more balanced development, and upgrade the quality and efficiency of Chinese industries.

Last week, China's Finance Minister Lou Jiwei said the country's economy could expand less than the government's target in 2013, and added that in the future China could tolerate growth as low as 6.5 percent.

Official figures from the country’s statistics bureau indicate the economy grew 7.5 percent in the April to June period, compared to the same period a year earlier.

“China's economy has maintained a steady growth,” said Sheng Laiyuan, spokesman for China's National Bureau of Statistics, “The GDP totaled 24.8 trillion yuan ($4 trillion U.S.) in the first six months, up 7.6 percent from a year earlier. GDP grew 7.7 percent in the first quarter and 7.5 percent in the second."

Other growth indicators - such as factory output and investment - also weakened compared to a year ago.

Sheng Laiyuan said that the figures are all within the country's economic targets, but added that China's economic conditions are still “complex and changeable.”

The continuing slowdown comes as Chinese leaders push through measures aimed at rebalancing the country's economy, diminishing its reliance on manufacturing for exports and government investment in core industries.

Shaun Rein, managing director at the China Market Research Group, says that the latest data show China’s economy is still overly reliant in investments in physical assets, such as real estate and infrastructure.

“Fixed asset investment grew 20.1 percent year over year, that is still far too high, we should be more on the 18 to 19 percent range,” he said.

As Economy Slows, China Tries to Rebalance Industry

Rein says that more of the economy needs to depend on consumer spending and the latest figures show that may be happening. Retails sales grew 13.3 percent in the first half of 2013 - an indication that consumers are starting to account for a bigger slice of GDP growth.

“You still see continued consumer confidence, continued spending going forward,” he says, “but it's not an easy switch and there will be pains in the economy going forward as we make that shift.”

The Chinese government has been enacting a series of policies to curb speculation in sectors like real estate, construction and banking, which traditionally accounted for much of the Asian giant’s economic growth.

Sheng Laiyuan said that such interventions will prove essential in the long term.

“Some measures, including the intensified property-tightening campaign, new rules to curb misuse of public funds and the exit of some previous stimulus policies, will inevitably have some impact on growth in the short term, but they will benefit our economy in the long run," he said during Monday's news conference.

Further Signs of Slowing Ahead

In a research note published on Monday, Nomura economists Zhiwei Zhang and Wendy Chen said that growth remains on track to achieve government's target of 7.5 percent for 2013.

But the economists revised down their GDP growth forecast for next year, from a previously forecasted 7.5 percent to 6.9 percent.

Zhang says that a decline in the workforce, as well as delays in structural reforms are contributing factors in the decision to lower estimate growth for 2014.

“The working-age population dropped in 2012 - the first time in at least 20 years - and this is a really big deal, because it changed the supply of labor and make the labor market much tighter then before and push up wage growth, and hurt China comparatively particularly in the export sector,” Zhang said in a conference call on Monday.

At the same time, Zhang says, policymakers have overlooked the development of private companies.

“The government tried in the past five years to encourage private investment and open up monopolies in the protected sectors, but there is very little action to follow up with those guidelines,” Zhang said.

In recent months, senior government officials have stressed the need to achieve a more balanced development, and upgrade the quality and efficiency of Chinese industries.

Last week, China's Finance Minister Lou Jiwei said the country's economy could expand less than the government's target in 2013, and added that in the future China could tolerate growth as low as 6.5 percent.