China soon is expected to reduce the number of business sectors that are barred from receiving foreign investment.

Vice Premier Wang Yang said Monday that China would submit the "new negative" list next week, but just how many sectors will open up remains uncertain.

The issue is a focus among top U.S. and Chinese officials at the "Strategic and Economic Dialogue" talks in Beijing this week. Washington has pushed Beijing to reduce the number of investment areas that are reserved for local businesses.

New deadline

China failed to keep its self imposed deadline for releasing the list last March. That caused disappointment among U.S. dialogue participants who felt such delays could affect the negotiations for a broader business investment treaty between the two countries, which President Barack Obama and Chinese President Xi Jinping agreed to pursue last September.

Chinese leaders including Premier Li Keqing have repeatedly indicated that the negative list would only keep a few sensitive sectors off-limits. But the recent economic slowdown in China may have led authorities there to delay its release to protect local industries as long as possible, analysts said.

"This may be a small step in the right direction," Julian Evans-Pritchard, China Economist at Capital Economics told VOA. "China is more willing to cooperate in the economic field than it is in the political sphere. But trade and investment issues are also used as bargaining chips in overall negotiations. So we will have to see how it turns out."

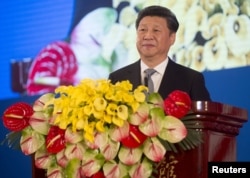

China's President opened the bilateral talks on Monday exuding hopes of reaching a strong investment agreement. "We must make our best efforts to achieve a mutually beneficial China-U.S. investment agreement at an early date and create new bright spots in bilateral economic and trade cooperation," Xi said.

However the fact that officials are waiting for the end of the dialogue to announce the list makes some observers pessimistic.Scott Kennedy, Deputy Director, Freeman Chair in China Studies at the Center for Strategic & International Studies, said the meeting is a moment when US and Chinese officials are focusing on the relationship and it is disappointing that China did not provide it in advance. "It makes one wonder how important the S&ED meeting is to China’s leadership."

Jack Lew's worries

Apart from China's restrictive investment laws, there are also U.S. concerns over China's industrial overcapacity, in which businesses sell products such as steel at below-market rates. In his remarks at Monday’s opening ceremony, U.S. Treasury Secretary Jack Lew said the practice puts tremendous pressure on the global economy.

"Excess capacity has a distorting and damaging effect on global markets. Implementing policies to substantially reduce production in a range of sectors suffering from overcapacity, including steel and aluminum, is critical to the function and stability of international markets," he said.

Although the U.S. is looking at the problem of Chinese industrial overcapacity from the standpoint of the global economy, observers say Beijing looks at those industries as important for providing jobs.

For example, analysts believe more than 25 million people are employed in China's energy sector, likely many more workers than the sector actually needs. Although reforming such industrial sectors is essential to make them more efficient and competitive, Beijing is worried that would result in layoffs, leading to higher unemployment and social unrest.

U.S. businesses are skeptical about China's promise to open up more to foreign investment. Past experience has shown that local governments often delay implementation of a new list or create administrative bottlenecks to delay opening up sectors even after the central government announces reforms.

"There is a growing distrust about China's desire to open up investment sectors. The Shanghai Free Trade Zone promised to encourage foreign investors in a wide range of new sectors. But foreign businesses are complaining that they are not getting adequate market access," economist Evans-Pritchard said.

China might consider relaxing investment controls in pharmaceuticals, hospitality and some other service sectors, which do not suffer from overcapacity. But Beijing will continue to keep telecommunications, heavy industry and traditional industries far from the reach of foreign investors, he said.

China's technology thirst

At the same time, China feels the need to attract more investments and infuse new technologies to upgrade its industrial sector and enhance the quality of its exports.The government has also committed itself to creating an "innovative society" by encouraging infusion of new technologies across the board. China still has a weak research and development base despite its high industrial growth, and depends heavily on either imports or imitation of foreign technology.

Bringing in more foreign technologies is possible only if China opens up new investment sectors, which is why it is ready to cautiously open up a few sectors, analysts said.