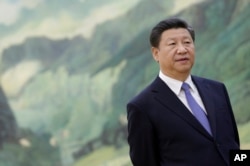

Chinese President Xi Jinping is defending his government's dramatic moves to stabilize stock markets in recent months, indicating Beijing will remain heavily involved in regulating the exchanges.

Xi told the Wall Street Journal in an interview published Tuesday that order and freedom are both essential for financial markets.

Critics have accused Beijing of overreacting to the stock market losses by forcing companies to hold on to shares, pumping billions of dollars into the exchanges to prop up share values and punishing “rumor mongering” that authorities have blamed for driving down prices.

The Chinese leader gave no indication such practices would stop saying instead that “we need to make good use of both the invisible hand and the visible hand.”

Unfair treatment?

Some foreign owned businesses operating in China have complained in the last year about regulators and state prosecutors who have appeared to target foreign businesses for alleged improprieties.

The president said Beijing treats both domestic and Chinese companies equally, and there is no unfairness in the government’s dealings.

But the American Chamber of Commerce in China sees the situation differently.

"AmCham China members have struggled with the challenges that impact their ability and willingness to invest in the market," James Zimmerman, chairman of the American Chamber of Commerce in China told VOA. He listed the challenges as "regulatory ambiguity and unequal approval procedures and standards" that favor domestic service providers and companies.

Zimmerman said the proposed Bilateral Investment Treaty between the two countries is unlikely to happen during this visit.

"But we are certainly hoping for rapid progress," he noted. There is a perception in the business community that "the doors may be closing to much needed foreign investment."

Foreign stock market links

The Chinese economy has shown signs of weakness for months, with falling exports, a declining yuan and $5 billion in losses on the Shanghai stock exchange since mid June.

“One of the potential risks to the economy is financial risk volatility. This may look a bit scary in the short term but it is a sign China is integrating in the global economy,” said Yang Xiyu, an expert with the government-run China Institute of Contemporary Foreign Relations.

This week, the Shanghai exchange said it has initiated moves to link itself with the London Stock Exchange. It is also discussing way for sharing stock data with Euronext, the equities exchange covering stocks of several European countries. At present, Chinese stocks are listed on the New York exchange and NASDAQ besides exchanges in Shanghai, Shenzhen and Hong Kong.

Analysts said Xi is trying to encourage Chinese companies to look at Europe for listing their companies and making investments.

“It’s going to be a useful channel for Chinese investors looking at foreign stocks,” said Andrew Batson, China research director at consulting firm, Gavekal Dragonomics. “This is one of the things London is hoping for.”

It remains unclear how foreign investors will react to the ability to more easily purchase Chinese stocks.

“Linking with London may make things easier for foreign investors. But the real issue is how much you want to invest in Chinese stocks,” Batson said.

“It will mostly depend on demand for Chinese stocks. At the moment there is not much demand because the fundamentals of the Chinese economy are not strong.”