BEIJING —

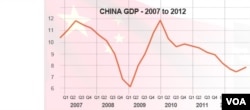

China released figures Friday that show the world's second largest economy appears to be recovering after nearly two years of slower growth. While some are optimistic that the figures mean the Chinese economy will continue to see stable growth in the year ahead, others are concerned about the lingering threat of weaknesses at home and overseas.

Chinese officials say the economy grew by 7.8 percent in 2012. That figure was right around the levels the government had projected, but still the slowest growth China’s economy has seen since 1999.

Shaun Rein, managing director at the China Market Research Group says that the slower growth rate is actually healthy. He says that over the past 10 years, China has relied too heavily on infrastructure investment and manufacturing exports.

“What we need to do is create more consumption and so we need to have the government green light healthier business projects, rather than just green lighting anything in order to get higher GDP growth because the result has been far too much pollution, and really inefficient investment,” said Rein.

Guiding the economy toward a healthier economic growth model is one of the key challenges China’s new leaders, incoming president Xi Jinping and premier Li Keqiang, will face.

Chinese officials and economists have long spoken of the need for China to boost domestic consumption or the role that consumer spending plays in the country’s overall growth.

Retail sales, China’s key gauge of consumer spending rose more than 14 percent last year. The government is also making efforts to boost private investment.

Zheng Xinli, deputy director of the Communist Party’s economic committee, was upbeat in his analysis of the economy when speaking with state-run broadcaster CCTV.

Zheng says consumer spending is already picking up and the pace of the private economy and investment has seen a noticeable uptick. He says all of this indicates the impact domestic growth is having on the economy is strengthening.

To boost domestic consumption even more, economists frequently note the need to allow private enterprises to play a bigger role in China’s economy. China made a major push toward privatization in the late 1990s, but when the financial crisis hit in 2008, the government’s stimulus put too much attention on state owned companies, analyst Rein says.

"So you've sort of had an imbalance in the last four years where state-owned enterprises have accounted for far too much of the economic growth and labor market within China," Rein explained. "So what we need to start doing is re-tilting and rebounding back towards the private sectors, specifically small medium enterprises.”

Hu Xingdou, a professor of economics at the Beijing Institute for Technology says financial reform is a key issue that China’s leaders need to address as they try to normalize the economy. And ensuring that private companies have access to funds to grow their businesses is a key part of that process.

Hu says state owned monopolies have already seriously suffocated the Chinese economy, especially the private economy. He says the state’s control of financial enterprises has led to a situation where all the funds are left to state owned enterprises, and the small and medium enterprises have a hard time getting loans and financing.

To address this need, the Chinese government has approved several new so-called pilot zones where private enterprises have access to alternative funds.

Hu says that while the reforms may help, they will not be enough.

Hu says that it is possible that in these pilot areas there will be more multiplicity in the banking system, and that all sorts of banks will be established and that this will help the situation. But, he adds, it is unlikely they will break the control state run monopolies have on the financial system.

Economists say it is important that the financial sector reform because that will help China strengthen the development of its real economy. And the less China relies on exports for growth and investment in infrastructure, they say, the more strength it will have to weather global financial storms.

Chinese officials say the economy grew by 7.8 percent in 2012. That figure was right around the levels the government had projected, but still the slowest growth China’s economy has seen since 1999.

Shaun Rein, managing director at the China Market Research Group says that the slower growth rate is actually healthy. He says that over the past 10 years, China has relied too heavily on infrastructure investment and manufacturing exports.

“What we need to do is create more consumption and so we need to have the government green light healthier business projects, rather than just green lighting anything in order to get higher GDP growth because the result has been far too much pollution, and really inefficient investment,” said Rein.

Guiding the economy toward a healthier economic growth model is one of the key challenges China’s new leaders, incoming president Xi Jinping and premier Li Keqiang, will face.

Chinese officials and economists have long spoken of the need for China to boost domestic consumption or the role that consumer spending plays in the country’s overall growth.

Retail sales, China’s key gauge of consumer spending rose more than 14 percent last year. The government is also making efforts to boost private investment.

Zheng Xinli, deputy director of the Communist Party’s economic committee, was upbeat in his analysis of the economy when speaking with state-run broadcaster CCTV.

Zheng says consumer spending is already picking up and the pace of the private economy and investment has seen a noticeable uptick. He says all of this indicates the impact domestic growth is having on the economy is strengthening.

To boost domestic consumption even more, economists frequently note the need to allow private enterprises to play a bigger role in China’s economy. China made a major push toward privatization in the late 1990s, but when the financial crisis hit in 2008, the government’s stimulus put too much attention on state owned companies, analyst Rein says.

"So you've sort of had an imbalance in the last four years where state-owned enterprises have accounted for far too much of the economic growth and labor market within China," Rein explained. "So what we need to start doing is re-tilting and rebounding back towards the private sectors, specifically small medium enterprises.”

Hu Xingdou, a professor of economics at the Beijing Institute for Technology says financial reform is a key issue that China’s leaders need to address as they try to normalize the economy. And ensuring that private companies have access to funds to grow their businesses is a key part of that process.

Hu says state owned monopolies have already seriously suffocated the Chinese economy, especially the private economy. He says the state’s control of financial enterprises has led to a situation where all the funds are left to state owned enterprises, and the small and medium enterprises have a hard time getting loans and financing.

To address this need, the Chinese government has approved several new so-called pilot zones where private enterprises have access to alternative funds.

Hu says that while the reforms may help, they will not be enough.

Hu says that it is possible that in these pilot areas there will be more multiplicity in the banking system, and that all sorts of banks will be established and that this will help the situation. But, he adds, it is unlikely they will break the control state run monopolies have on the financial system.

Economists say it is important that the financial sector reform because that will help China strengthen the development of its real economy. And the less China relies on exports for growth and investment in infrastructure, they say, the more strength it will have to weather global financial storms.