The Covid-19 pandemic has changed the nature of homebuying in the United States, but one constant is that Black Americans do not have the same access to a home of their own.

Black purchasers made up just six percent of the total homebuyers this year -- a figure that has changed little over the past two decades, a National Association of Realtors (NAR) report released Thursday said.

Pandemic dynamics have allowed many Americans to get caught up on student loans and build savings, since spending opportunities like travel and eating in restaurants were off limits.

As remote work became the norm, more buyers packed up and moved to be closer to family and friends rather than relocating for a job, according to NAR's 2021 Profile of Home Buyers and Sellers.

However Black Americans are weighed down by student loan debt to a greater degree than their white counterparts, and less able to get help from family, the report said.

"Unfortunately, race hasn't really changed much this year. We're still seeing pretty consistent, low shares of minority homebuyers," NAR's Jessica Lautz told AFP in an interview.

While low interest rates made mortgages more accessible, the now-chronic shortage of homes for sale has driven prices higher and kept many first-time buyers out of the market, the data showed.

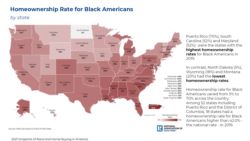

Even in the South, Blacks made up just nine percent of homebuyers in a region where their population in some states is more than double the 13 percent national average, the report said.

Prior NAR research shows white homeownership rates are 30 percentage points higher than those of Black buyers, who are more than twice as likely to have student loan debt and a higher amount, and are rejected for mortgages at more than twice the rate as white applicants.

And because they are less likely to own homes, they are not able to use proceeds from the sale of a home to finance a purchase.

Priced out

While the share of first-time buyers rose this year, it remains below the historic norm of 40 percent, said Lautz, NAR's vice president of demographics and behavioral insights.

"We know that first-time homebuyers are struggling to enter into this housing market," she said, adding they find it hard "to pull the money together and then to be able to compete with other buyers" who increasingly can pay all cash.

With historically low inventory -- exacerbated by a shortage of workers and supply issues and tendency for builders to focus on large, expensive houses -- sellers are getting full asking price and more for their homes, and a higher share of buyers can pay cash.

The median home price was $305,000, more than $30,000 higher than in 2020, according to the report.

President Joe Biden has made lowering home prices a plank of his Build Back Better bill under consideration in Congress, calling for $150 billion for "the single largest and most comprehensive investment in affordable housing in history."

His plan would offer down payment assistance to help more buyers own their first home and build wealth, and focus on zoning reform to allow more construction.

Close to family

One of the biggest shifts during the pandemic has been the increase in demand for work-from-home opportunities as offices shut down.

"Home sellers are saying their number-one reason to sell is to get closer to friends and family," Lautz said. "People really wanted their support system around them and needed it during the pandemic."

Job relocation as the reason to move fell to seven percent from 11 percent.

She said she expects that trend to continue "as CEOs understand if they want to retain talent, they may need to allow more flexibility in working from home."

Another trend is the dwindling share of homebuyers with children, which fell to 31 percent -- the lowest on record, she said.

That shifts priorities, since those buyers will be less concerned about issues like schools or larger homes, which for cash-strapped buyers will "open up neighborhoods for them that would have been off limits if they had children in the home."